- Chin Hin Group said it aims to develop a housing project on the land with an estimated gross development cost of RM448 million.

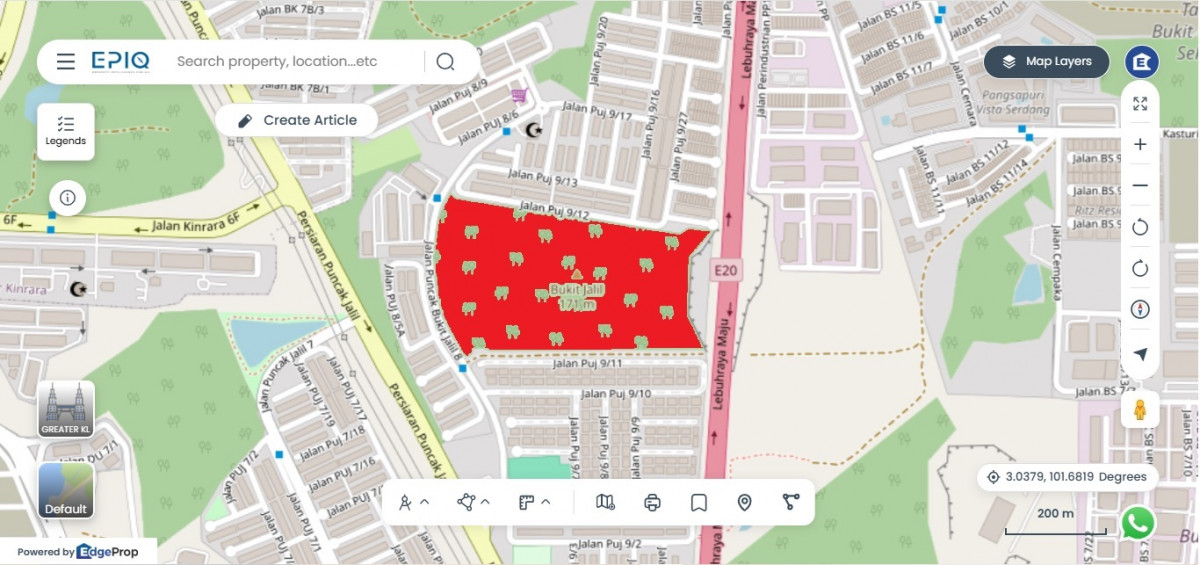

KUALA LUMPUR (Nov 26): Chin Hin Group Property Bhd (KL:CHGP) said it is buying 25.9 acres of land just outside Kuala Lumpur for RM91 million in cash to develop a housing project with an estimated gross development value (GDV) of RM560 million.

The developer’s unit, Chin Hin Property (KL) Sdn Bhd, inked an agreement with Trident Treasure Sdn Bhd on Wednesday (Nov 26) to purchase the land in Seri Kembangan, according to an exchange filing.

Chin Hin Group said it aims to develop a housing project on the land with an estimated gross development cost of RM448 million. The project is expected to commence in the fourth quarter of 2026 and be completed by end-2029.

The land already bears approval for an apartment project but the current landowner, Trident Treasure, has submitted an application to amend the approval to 380 units of three-storey terrace houses.

Chin Hin Group said it is unable to procure the land’s net book value as it was not privy to the information at this juncture. The group also did not undertake a formal valuation process on the land.

The land’s price tag translates approximately to RM80 per sq ft. Chin Hin Group Property said that based on “informal discussions with a valuer familiar with the land values in the surrounding area”, the relevant estimated market value ranges from RM70 to RM85 per sq ft, depending on land size and development potential.

The consideration is expected to be funded via internally generated funds and borrowings, the group said.

The land buy is expected to be completed in August 2026, it added.

According to Chin Hin Group, Trident Treasure is a property developer, 60% owned by Istilah Makmur Sdn Bhd while the remainder is held by Winax Development Sdn Bhd.

Based on checks with the Companies Commission Malaysia, Winax Development is wholly owned by Talam Transform Bhd (KL:TALAMT). Istilah Makmur is 41.66% held by Choo Choon Seng, 41.66% by Tee Chai Seng, 8.33% by Tan Huck Joo and 8.33% by Tan Che.

Shares in Chin Hin Group ended one sen or 0.84% lower at RM1.18, valuing the group at RM1.57 billion.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.