The Johor Bahru (JB) property market is starting to look like a circus.

If you have visited a sales gallery in JB recently, you have seen the madness. Developers are slapping four-figure psf price tags on high-rise units that haven't even broken ground. We are seeing new launches near the JB–Singapore Rapid Transit System (RTS) asking for RM1,500 psf.

To put that into perspective, the median transacted price for subsale properties in the same area is hovering just below RM900 psf. Genuine transactions today at above RM1,000 psf is almost non-existent and doesn't even make up 0.1% of JB high-rise transactions in the years 2024–2025.

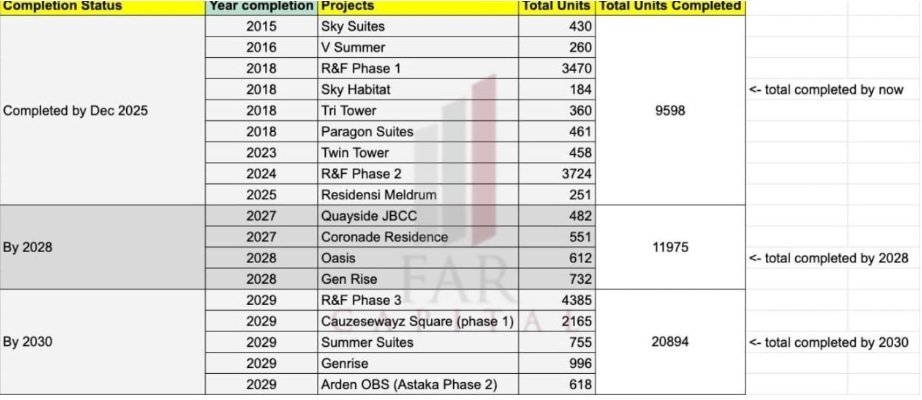

When new launch prices detach this aggressively from the actual secondary market, combined with more than tripling of existing supply, that is the textbook definition of a property bubble.

Oversupply + overvalued + over hyped rarely has a happy ending.

The market is being flooded by what we call "Overhype Enablers" - investors who are blindly throwing money at anything with a "Coming Soon" sign, paying 2029 prices in 2025. They are betting that once the RTS Link starts running, prices will miraculously jump to RM2,000 psf.

This is eerily similar to the Iskandar Puteri property bubble that happened in 2013–2023. Many people lost a lot of money in that era, some seeing their property values drop by more than 50%.

Here is the cold, hard truth about the current situation around RTS JB: Many of them will get burned, but the rare few will make crazy returns if they bought at the right price, time their completion properly, and exit before the peak oversupply happens.

The Singapore reality check

So, what's driving the phenomena we are seeing today in RTS? On paper, buying RTS at today’s prices makes a lot of sense.

In Singapore, the property market has become brutal. New launches in non-premium addresses are now hitting S$1,800 (approximately RM6,000) psf.

A standard 3-bedroom HDB flat with zero facilities now commands a rental of S$4,000 (RM13,000+).

Compare that to JB. Even at the "inflated" prices, you can get a luxury condo with a swimming pool, gym, and retail integration for a fraction of the cost.

Singapore: S$1,800 psf

JB: RM1,300–1,500 psf (at the absolute peak)

The gap is simply too massive to ignore. The RTS Link isn't just a train; it is a pressure release valve for Singapore's high cost of living pressure. So on paper, the RTS story makes sense.

The "retirement village" phenomenon—RTS?

Not all is bad news when it comes to RTS. Far Capital's ground research in Singapore has uncovered a massive trend that most agents aren't talking about yet.

Singapore is aging. The "dual key" concept is popular there, where grandparents live in the studio unit attached to the family home, but it is incredibly expensive.

The agency is seeing a surge of Singaporean retirees looking to treat JB as their retirement village. They want to sell their high-value HDB, cash out, and retire in luxury in JB, while their children continue working in Singapore.

With the RTS connected directly to Singapore's MRT (specifically the Red and Brown lines), visiting the grandkids is just a quick train ride away. This isn't speculation; it is already happening.

The ‘real opportunity’: It’s not just the RTS

Everyone is obsessed with the RTS. It's the obvious play, and why it's overpriced and over-hyped. That is why Tier S properties are ridiculously expensive.

But the smarter money is looking at the ART (Automated Rapid Transit).

The ART lines will connect the wider JB area directly to the RTS station. This means you can buy a property 10 minutes away from the RTS station for half the price, but still enjoy the same connectivity.

This is where the Rental Arbitrage happens:

* Tier S (RTS vicinity): Rental asks are RM3,300+.

* Tier 1 & 2 (ART-connected): You can still find rentals for RM2,000–RM3,000.

For a tenant, a 10-minute ART ride is worth saving RM1,500 in rent. For you, the investor, the entry price is vastly lower, meaning your yield is significantly higher, and your risk is a lot lower, and you don't have to compete with tens of thousands of similar supply.

How to buy without getting burned: the 4 tiers of JB

If you buy the wrong tier at the wrong price, you become the "greater fool." On the other hand, FAR Capital uses strictly defined tiers to ensure you never overpay.

Here is the cheat sheet the property consultancy uses for its own portfolio:

Tier S (The "HYPE Zone")

* Location: Within walking distance to RTS/CIQ (customs, immigration, and quarantine complex)

* The hype: New launches hitting RM1,500 psf

* The reality: Subsale median is barely RM900 psf

* Far Capital’s Buy Rule: Below RM900 psf for a new property. Anything above that is speculation.

Tier 1 (The Sweet Spot and the real opportunity)

* Location: Slightly further out but conveniently connected to RTS. Additional 10–20 minutes’ distance but 50% cheaper

* Market: Transacted RM500–RM800 psf

* Far Capital’s Buy Rule: Below RM600 psf. This gives you an instant safety buffer. These are areas where expatriates and non-Malaysians will stay.

* Rental potential: RM3,000–RM5,000

Tier 2 (The Value Play)

* Location: Along the upcoming ART lines

* Market: Transacted RM350-500 psf.

* Far Capital’s Buy Rule: Below RM500 psf.

Tier 3 (The Budget Entry)

* Location: Surrounded by older landed properties priced below RM600k.

* Far Capital’s Buy Rule: Below RM350 psf.

Note: Non-Malaysians should avoid Tier 2 and Tier 3 because they are hard to exit with lack of international buyer interest.

The window is closing

2024 will be cheaper than 2026. That is a fact.

Prices today have "priced in" the RTS premium, but the real explosion in rental demand will only happen 12 to 24 months after the RTS is completed and the daily commute becomes seamless.

But be careful before the market hits critical oversupply of new units completing and competing with you for tenants.

You have a choice.

You can be the "Overhype Enabler" who pays RM1,500 psf today and prays for a miracle.

Or you can be the strategic investor who uses FAR Capital’s data to buy a Tier 1 asset at 60% cheaper, and drastically reduce your risk while generating above 8% returns. For example, in 2022, Far Capital clients acquired properties within 10 minutes to RTS at below RM400 psf, and below RM450 psf, which were close to 50% off. These properties today can generate above 10% gross rental returns due to lack of new supply, lack of competition.

Far Capital currently has access to exclusive bulk deals in Tier 1 and Tier 2 zones that are selling WAY below the developer's brochure price.

Reach out to Far Capital’s professional advisory, and get access to the best property deals in Malaysia.

Don't follow the herd. Follow the data.

Interested in this project?

Drop your details if you'd like a sales consultant to contact you.

In this Series

Learn how banks are transforming

Video: Innovation at work

Video: The new digital bank

Video: The new digital bank