Sunway Bhd May 30 (RM3.01)

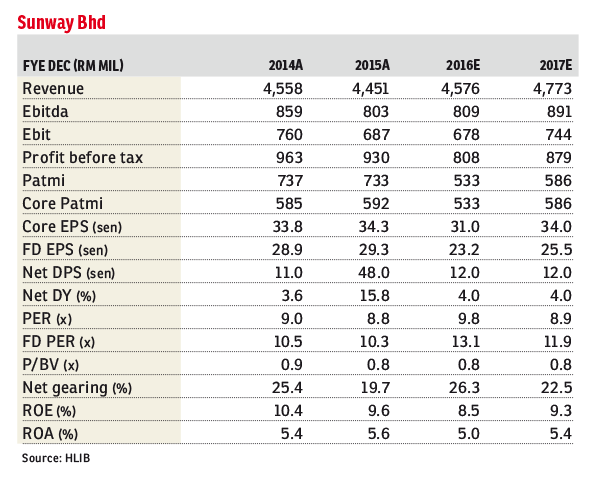

Maintain buy with a slightly lower target price (TP) of RM3.72: Sunway Bhd’s first quarter of financial year 2016 (1QFY16) core earnings were slightly below expectations, falling 20% year-on-year (y-o-y) to RM105 million, making up 17% of our and the consensus full-year forecasts.

1Q is a seasonally weaker quarter, comprising 19% to 22% of its historical full-year earnings.

1QFY16 core profit fell 20% y-o-y to RM105 million, mainly due to weaker contributions from all segments. Revenue dropped by 44% quarter-on-quarter, due to lower progress billings from ongoing local projects and a higher base in 4QFY15, which was boosted by higher recognition from a few projects.

Effective property sales in 1QFY16 were RM198 million (versus RM348 million in 4QFY15), accounting for 18% of the full-year sales target of RM1.1 billion (+21% y-o-y). We expect stronger sales ahead, on the back of RM1.6 billion worth of new project launches.

Major launches in FY16 include Sunway Gandaria (gross development value: RM200 million), Sunway Geo Residences 3 (RM400 million), Casa Kiara 3 (RM200 million), Velocity (RM200 million), Sunway Iskandar (RM400 million) and others.

Its order book currently stands at a record high of RM5 billion, translating into a healthy cover ratio of 2.6 times FY15 revenue. Given its strong track record, Sunway Construction Group Bhd (SunCon) has a strong chance to secure some packages of jobs, such as the Light Rail Transit 3 (RM9 billion), Pan Borneo Highway (RM16 billion), Damansara–Shah Alam Elevated Expressway (RM4 billion) and Sungai Besi-Ulu Kelang Elevated Expressway (RM4 billion). Management is targeting to secure RM2.5 billion worth of new contracts in FY16.

We see potential risks to Sunway in: i) execution risks; ii) regulatory and political risks (both domestic and overseas); iii) rising raw material prices; and iv) an unexpected downturn in the construction and property cycle.

Our FY16 and FY17 earnings estimates are reduced by 10% and 6.5% respectively after incorporating slower progress recognition from property development and lower contribution from construction. Following our downgrading of SunCon’s TP from RM1.94 to RM1.84 post-earnings results, our TP for Sunway is reduced slightly by three sen per share to RM3.72.

We maintain “buy”, with our TP adjusted slightly from RM3.75 to RM3.72. — Hong Leong Investment Bank Research, May 30

This article first appeared in The Edge Financial Daily, on May 31, 2016. Subscribe to The Edge Financial Daily here.