- EcoWorld said the land would enable the group to broaden its range of commercial offerings under its Eco Hubs and Eco Rise product pillars.

KUALA LUMPUR (Oct 17): Eco World Development Group Bhd’s 81%-owned subsidiary, Mutiara Balau Sdn Bhd, has entered into a conditional sale and purchase agreement (SPA) with Boustead Balau Sdn Bhd (BBSB) to acquire a 22.73-acre freehold commercial parcel in Mukim Semenyih, Selangor, for RM82.19 million.

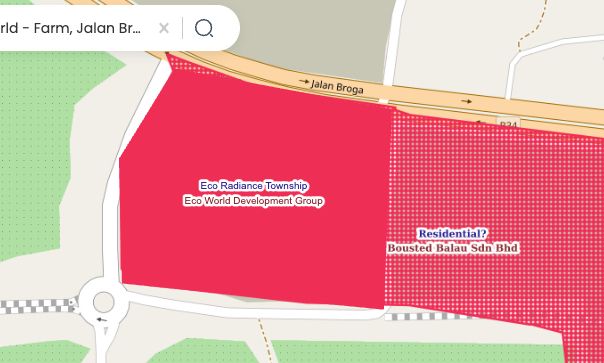

In a bourse filing on Friday, the proposed acquisition involves land measuring approximately 92,000 sq m located adjacent to EcoWorld’s upcoming Eco Radiance township. BBSB is a wholly-owned subsidiary of Boustead Properties Bhd (BProp), which also holds a 19% equity interest in Mutiara Balau.

Under the agreement, Mutiara Balau will acquire the land on an “as is where is” basis, free from encumbrances and with vacant possession.

The purchase will be funded through a combination of shareholders’ advances and project-level bank borrowings, while EcoWorld will finance its portion via internal funds and borrowings.

Expanding the Eco Radiance footprint

Eco Radiance, which spans 847 acres and carries an estimated gross development value (GDV) of RM4.6 billion, is EcoWorld’s third township in the Semenyih growth corridor.

The newly acquired parcel, fronting Jalan Broga, is expected to enhance visibility, connectivity, and frontage for the overall township.

EcoWorld said the land would enable the group to broaden its range of commercial offerings under its Eco Hubs and Eco Rise product pillars.

Subject to market conditions, the company expects to launch the commercial components—which may include shopoffices, serviced apartments and its “Duduk by EcoWorld” series—upon completion of the acquisition.

The preliminary GDV of the new land is estimated at RM560 million, bringing the total combined GDV for Eco Radiance to RM5.16 billion. The acquisition is expected to be completed by the first quarter of 2026.

The SPA is conditional upon approval from the Equity Development Division (Ministry of Economy) within three months from the date of signing, with an automatic two-month extension. If the condition is not met within the specified period, the agreement may be terminated, and deposits refunded.

The purchase consideration will be settled in stages—a 2% earnest deposit paid before signing, 8% upon execution, and the remaining 90% within three months after the SPA becomes unconditional, with a one-month automatic extension.

The group is of the view that the proposed acquisition is in the company’s best interest, fair and reasonable, and on normal commercial terms.

The transaction is classified as a related party transaction due to BProp’s 19% stake in Mutiara Balau, but it is exempted from requiring independent adviser and shareholder approval under Bursa Malaysia’s Listing Requirements.

The group expects the land purchase and ensuing development to contribute positively to its future earnings and enhance its long-term growth prospects.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.