- The pharmaceutical group said the purchases will be funded by proceeds raised through its regularisation plan, which is part of the group’s strategy to strengthen its logistics infrastructure and expand distribution capacity across the east coast of Peninsular Malaysia as well as Sabah and Sarawak.

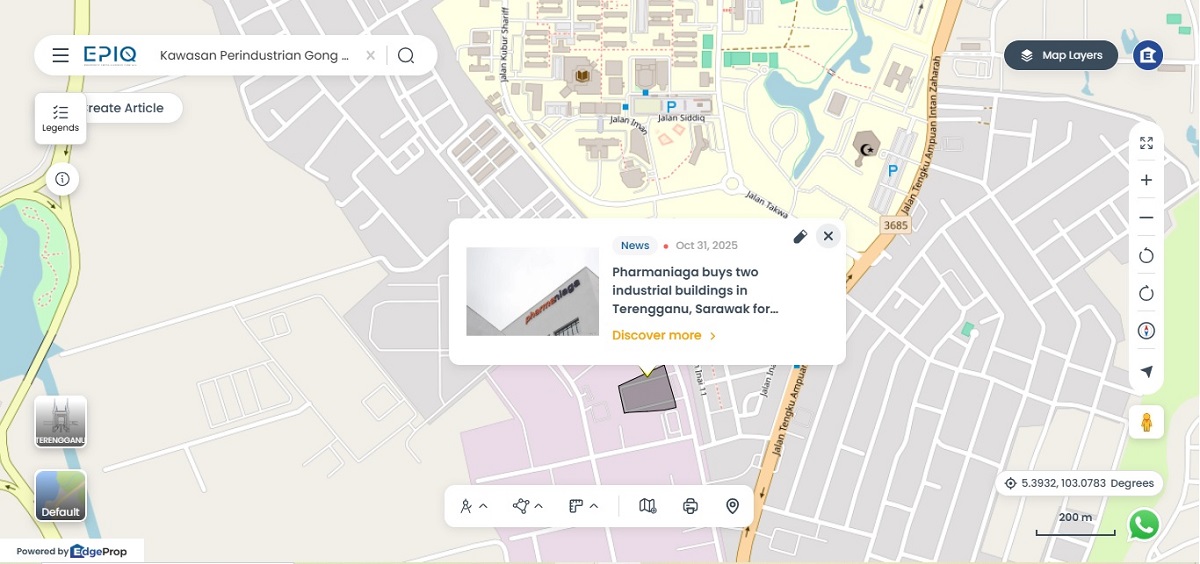

KUALA LUMPUR (Oct 30): Pharmaniaga Bhd (KL:PHARMA) is acquiring two industrial buildings in Terengganu and Sarawak for a total of RM30.5 million.

In two separate bourse filings on Thursday, the pharmaceutical group said the purchases will be funded by proceeds raised through its regularisation plan, which is part of the group’s strategy to strengthen its logistics infrastructure and expand distribution capacity across the east coast of Peninsular Malaysia as well as Sabah and Sarawak.

For the industry building in Terengganu, Pharmaniaga said it its wholly-owned unit Pharmaniaga Logistics Sdn Bhd is buying a single-storey detached building in the Gong Badak Industrial Area, Kuala Nerus, Terengganu from Sinoria Sdn Bhd for RM19.5 million.

The 11,549 sq m property sits on leasehold land and was valued by Shah Real Property Consultants at RM19.5 million in a report dated Sept 24, 2024. Early possession is expected by Feb 9, 2026, to allow for renovation works before completion.

Meanwhile, for the other property in Sarawak, it said Pharmaniaga Logistics has entered into a sale and purchase agreement with Hyper Shipping Sdn Bhd to acquire a single-storey industrial building at Kidurong Gateway, Bintulu, Sarawak for RM11 million.

The 3,731 sq m property, located in the Kidurong Industrial Area, was also valued by Shah Real Property Consultants in October 2024. Vacant possession is slated for Jan 9, 2026.

Pharmaniaga said both acquisitions align with its obligations under a concession agreement signed with the Ministry of Health on Jan 3, 2023, and are intended to enhance efficiency in medical supply distribution.

Earlier in August, Pharmaniaga completed its RM520 million capital reduction—the final step of its regularisation plan—which trimmed its issued share capital to RM249.62 million.

The completion paves the way for the group to exit its Practice Note 17 (PN17) status by the first quarter of 2026.

Prior to the exercise, Pharmaniaga embarked on a massive RM576 million fundraising exercise, including a RM223.7 million private placement that saw Jakel Capital Sdn Bhd emerge as its second-largest shareholder with a 10% stake.

Its shares closed unchanged at 24 sen on Thursday for a market capitalisation of RM1.57 billion.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.