- LSH Capital reported a quarterly net profit of RM34.60 million for 4QFY2025, up 5.2% compared with RM32.88 million a year earlier, on the back of higher-margin building materials trading under the construction segment and contributions from its new facilities management segment.

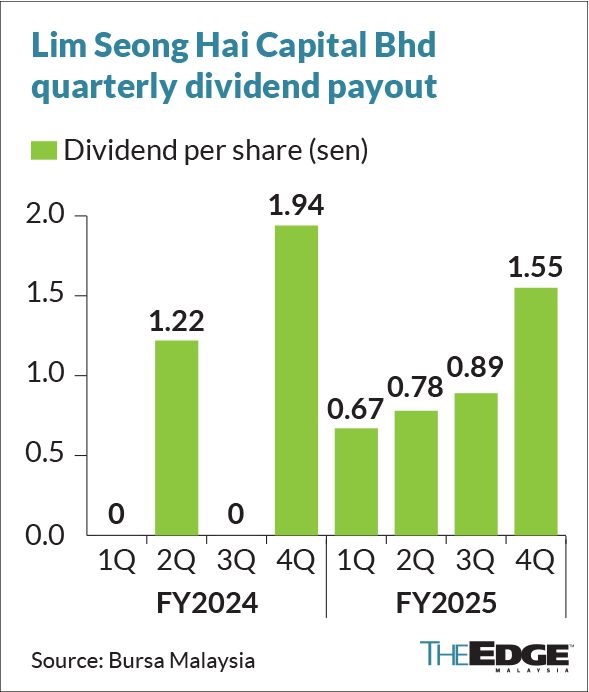

KUALA LUMPUR (Nov 25): Lim Seong Hai Capital Bhd (KL:LSH) has declared a fourth interim dividend of 1.55 sen per share, bringing the total dividend payout for the financial year ended Sept 30, 2025 (FY2025) to a record 3.89 sen.

The total dividend payout of RM32.6 million is equivalent to 31.6% of the group's FY2025 earnings.

The fourth interim dividend has an ex-date of Dec 10 and a payment date of Dec 22, according to the group's bourse filing on Tuesday (Nov 25).

In a separate filing, LSH Capital reported a quarterly net profit of RM34.60 million for 4QFY2025, up 5.2% compared with RM32.88 million a year earlier, on the back of higher-margin building materials trading under the construction segment and contributions from its new facilities management segment.

Earnings per share stood at 4.13 sen, versus 4.65 sen in 4QFY2024.

Quarterly revenue jumped 60.7% to RM135.49 million, underpinned by continued advancement in construction activities, progress at the LSH Segar property development project and contributions from the Kuala Lumpur Tower and River of Life’s Kolam Biru facilities management operations.

For the full year, LSH Capital posted a net profit of RM100.81 million, up 35.6% from RM74.33 million in FY2024, on the back of a 27.5% increase in revenue to RM460.73 million.

By segment, construction remained the largest contributor at RM276.58 million in revenue while property development more than doubled to RM158.60 million and facilities management contributed RM25.56 million for the financial year.

LSH Capital chairman Tan Sri Lim Keng Cheng said the strong results and record payout reflect the strength of its BEST Collaboration Framework, which was rolled out in 2021 to integrate construction, engineering, trading of construction products and property development capabilities into a cohesive value chain with its clients.

Under this framework, LSH Capital not only executes construction and engineering works but also provides construction-related services and solutions, including value engineering, design input and lifecycle planning, and participates alongside clients in project upside.

"When we rolled out the BEST framework in 2021, it was co-developed together with my children, who are now actively involved in different parts of the group," he said in a statement. "This intergenerational management model combines the experience of the founding generation with the energy and ideas of the next generation."

LSH Capital’s outstanding construction order book stands at RM1.31 billion comprising 16 ongoing projects while its property development portfolio now carries RM1.68 billion in gross development value, including new projects in Titiwangsa and the upcoming Morib Rejuvenation Project spanning 597 acres.

The group, which was initially listed on the LEAP Market in 2021, transferred its listing to the ACE Market in March this year.

Its shares rose seven sen or 3.3% to close at RM2.19 on Tuesday, valuing the group at RM1.84 billion. Year to date, the counter has surged over 163%.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.