KUALA LUMPUR (Jan 14): Malaysian real estate investment trusts (M-REITs) are expected to remain supported into 2026 by lower interest rates and catalysts from the Visit Malaysia 2026 (VM2026) tourism campaign, said Hong Leong Investment Bank (HLIB).

In a sector note, HLIB said M-REIT fundamentals remain constructive across most segments, with retail and hospitality REITs expected to be the main beneficiaries of stronger tourism demand.

Meanwhile, industrial REITs continue to enjoy robust occupier demand underpinned by sustained manufacturing investments.

The bank said the sector should continue to benefit from an accommodative interest rate environment, government support for household consumption via cash aid programmes, and a reduction in the service tax on rentals to 6% from 8% effective January 2026, which should ease cost pressures on tenants and support occupancy levels.

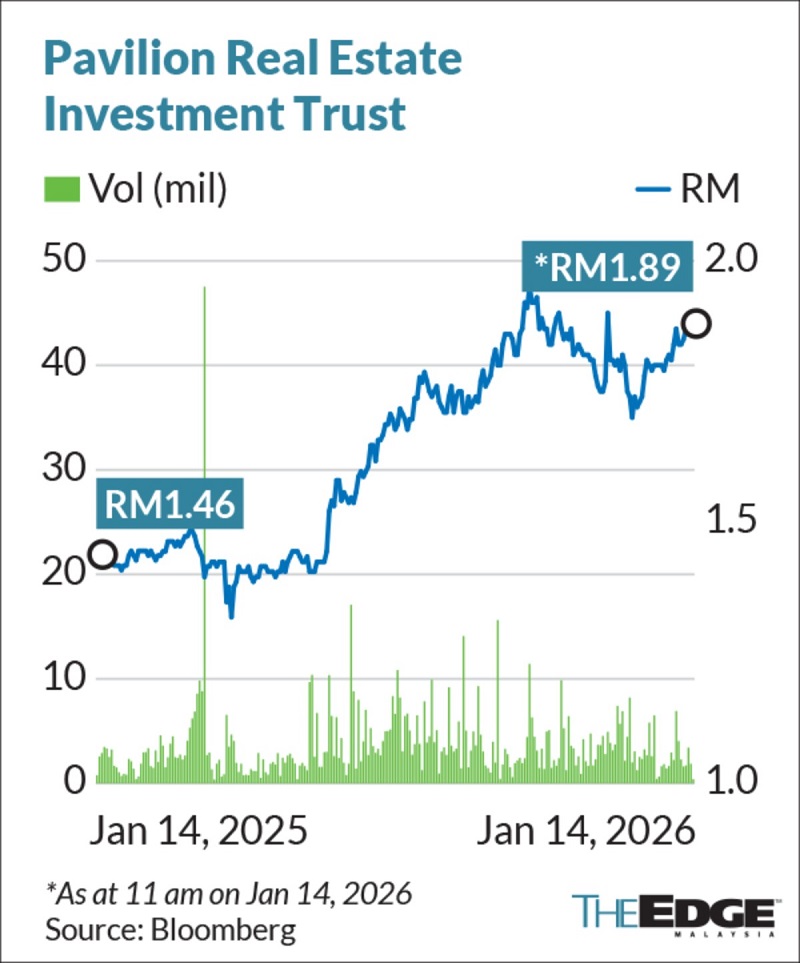

Among sub-sectors, retail and hospitality REITs are expected to gain from VM2026, rising tourist arrivals and stronger Chinese visitor momentum.

HLIB highlighted that Chinese tourists account for 20% of tourism receipts and tend to stay longer and spend more per day, providing earnings support to REITs with exposure to prime malls and hotels.

Simultaneously, the office segment is stabilising, with 2025 supply growth at a manageable 1.3%, though a larger 2.7% pipeline in 2026 may prompt tenant relocations.

The industrial REIT segment remains among the strongest performers, supported by resilient manufacturing investment, positive rental reversions and policy tailwinds under the New Industrial Master Plan 2030, National Energy Transition Roadmap and Government-Linked Enterprises Activation and Reform Programme (GEAR-uP).

On valuations, HLIB said M-REITs continue to trade at attractive yield spreads, with sector yields sitting about 0.6 standard deviation above the five-year average relative to 10-year Malaysian Government Securities, reinforcing the sector’s income appeal.

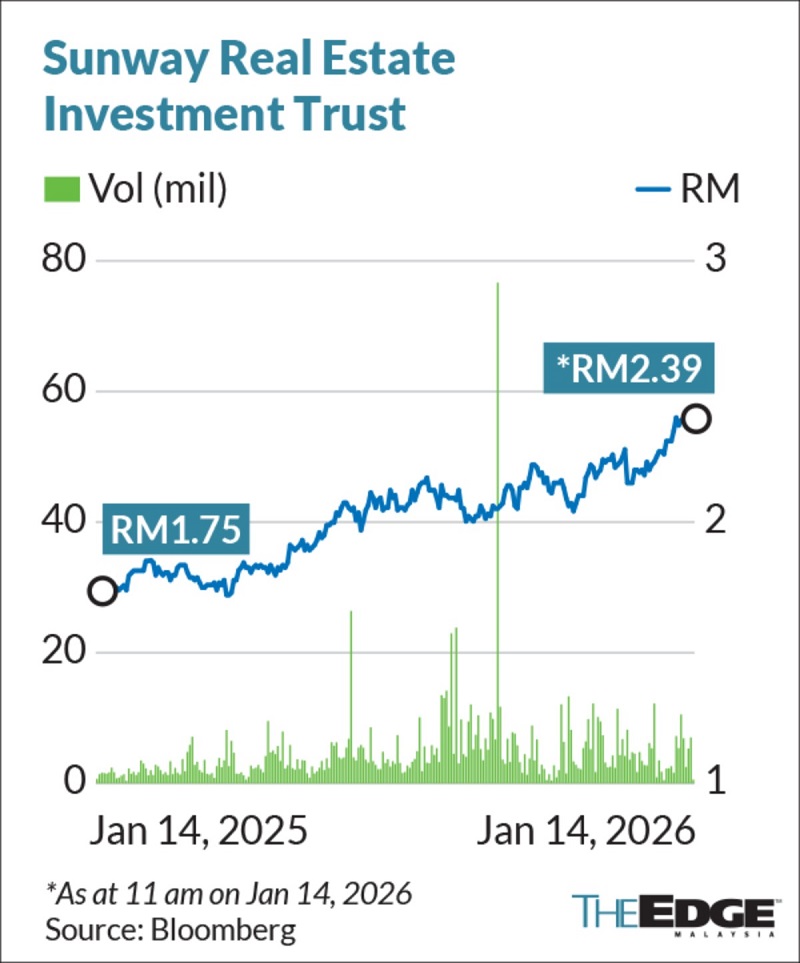

The bank noted that M-REITs outperformed the broader market in 2025, with the REIT Index up 8.3% versus a 2.3% gain in the FBM KLCI, driven by the July 2025 overnight policy rate cut and investors’ shift towards defensive yield assets.

HLIB maintained its ‘overweight’ stance on the sector and reiterated Sunway REIT (KL:SUNREIT) and Pavilion REIT (KL:PAVREIT) as its top sector

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.