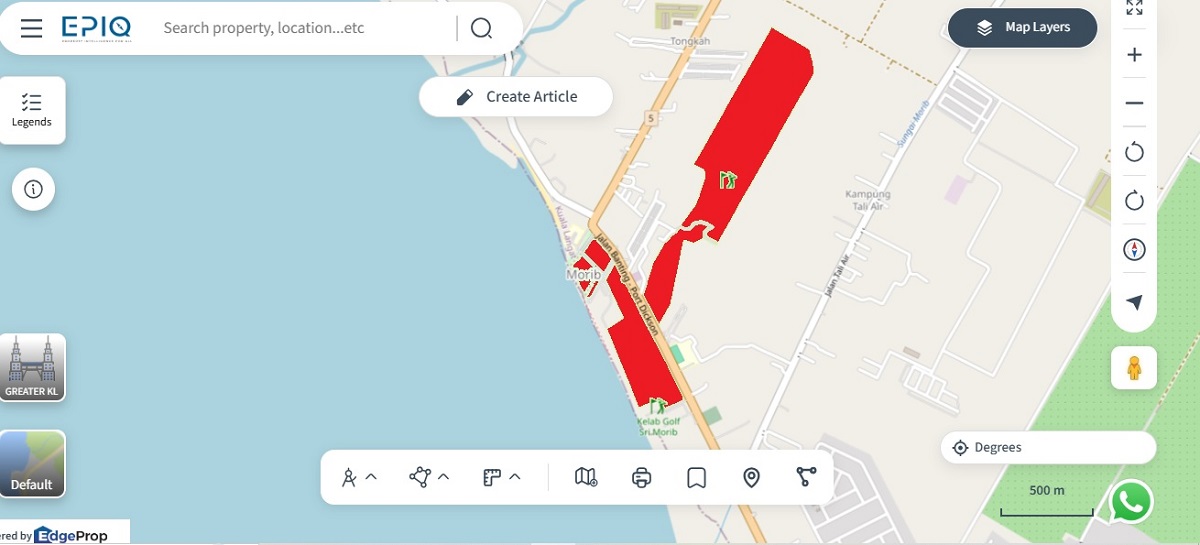

KUALA LUMPUR (Jan 23): Lim Seong Hai Capital Bhd (KL:LSH) plans to seek shareholders’ approval to partner with executive vice-chairman Datuk Lim Keng Guan’s Besteel Engtech Sdn Bhd and inject RM484.8 million for the Morib rejuvenation project, covering the renovation of the Sri Morib Golf Club and development of a 150-acre land nearby for residential and commercial use.

In a filing with Bursa Malaysia, the company said the total project cost is estimated at RM692.6 million.

The group said its wholly owned unit LSH Best Builders Sdn Bhd together with its wholly owned subsidiaries, LSH Morib Golf and Country Club Sdn Bhd and LSH Morib Development Sdn Bhd, have entered into a conditional share subscription agreement with Besteel for it to take 30% interests in the special purpose vehicles (SPVs). LSH also proposed to provide financial assistance to the SPVs. Both proposals require shareholders’ approval.

LSH plans to fund its portion of the cost of rejuvenation and development of RM484.8 million through a mix of internal funds and bank borrowings.

Under the plan, LSH Morib GCC will cover all costs for renovating and operating the eight-hole, 139-acre Sri Morib Golf & Country Club and will retain all revenue from its operations. A new clubhouse and hotel will also be built on five acres of beachfront land under a 30-year lease, renewable for another 30 years.

LSH will pay the landowners, Seriemas Resort Sdn Bhd (SRSB), Seriemas Development Sdn Bhd (SDSB) and Permodalan Negeri Selangor Bhd (PNSB), a percentage of revenue from the hotel and related services, while retaining other income from the property. LSH Morib GCC will manage and operate the golf course under a 60-year lease (initial 20 years plus two automatic 20-year renewals) and will pay lease fees to the landowners, with terms to be agreed.

Meanwhile, LSH Morib Development will lead the Morib development project, a mixed-use residential and commercial development valued at an estimated RM850 million over 10 years.

LSH will pay landowners, SRSB, SDSB and PNSB a share of the gross development value while keeping all proceeds from sales and covering all expenses. LSH Morib Development will have a 12-year right of first refusal to develop an additional 303 acres, giving the group a chance to expand and benefit from future projects.

LSH said the project is expected to provide long-term revenue and growth opportunities through recurring income from golf operations, hotel stays, and related services and residential and commercial sales on 150 acres, generating substantial revenue even after profit-sharing.

LSH will also secure a 450-acre landbank for future developments, ensuring flexibility and sustainable growth.

LSH has cash and bank balances of RM35.35 million and a total of RM8.73 million term loans as at September 30, 2025.

Shares in LSH closed down six sen or 3.1% to RM1.89 on Thursday, valuing the company at RM1.59 billion. The stock has more than doubled since its ACE Market debut at 88 sen on March 21, 2025.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.