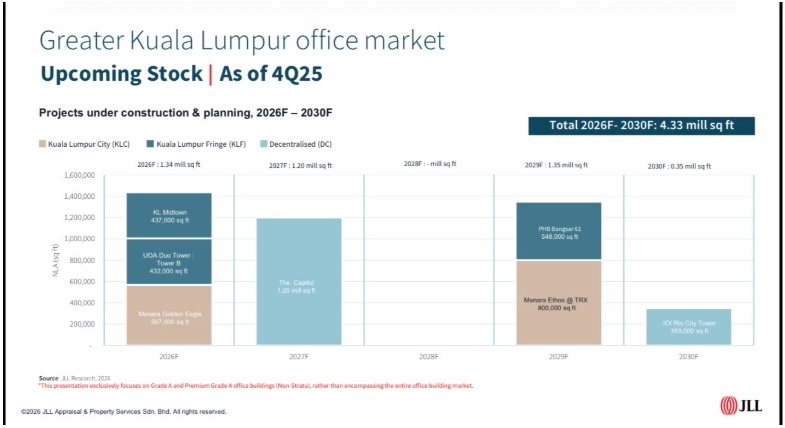

KUALA LUMPUR (Jan 29): Supply limitations in the Greater Kuala Lumpur office market are expected to intensify from 2027, with only a single non-strata Grade A office project scheduled for completion.

The building in question is The Capitol at Bandar Utama, Petaling Jaya, set for delivery in 2027, while no additional Grade A supply is projected for 2028, said JLL Malaysia head of office leasing advisory Quiny Lee during its 4Q2025 property market briefing here on Tuesday.

Lee noted that developers’ decisions are largely influenced by investment returns. They have remained cautious, as current office rents and yields are comparatively less attractive than other asset classes.

She also pointed out that local tenancy practices shape development strategies, as most agreements in Malaysia are structured as short-term tenancy contracts rather than long leases, typically spanning only three years, which in turn affects how developers plan new office projects.

Much of the office supply planned prior to and during the pandemic has already been delivered, contributing to the reduced pipeline in the coming years. Lee highlighted that this tightening of supply is expected to create greater pressure on vacancy and rental rates.

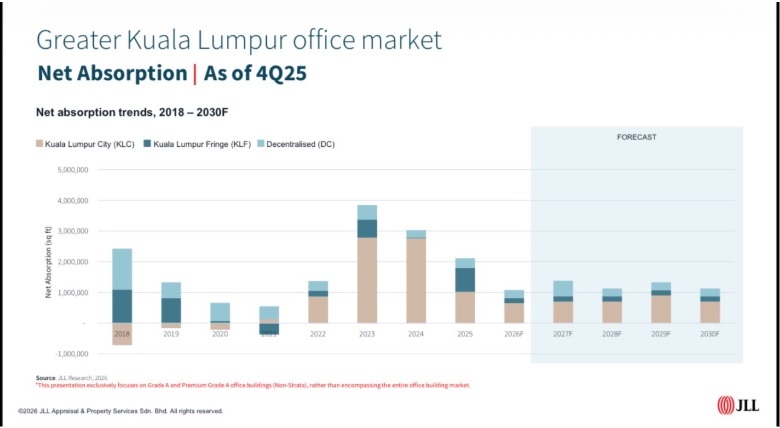

Early signs of this trend are already visible, with overall achievable office rents averaging RM6.81 psf per month in 2025, representing an increase of 0.33% compared to 2024.

Driven by the constrained pipeline of Grade A office supply alongside ongoing strong demand for high-quality space, the office market in Greater KL is projected to increasingly favour landlords in the coming years, allowing for more stable rental levels, and fewer concessions over the medium term.

The heightened demand is expected in both KL city centre and fringe areas. In 4Q2025, net absorption across the office market reached approximately 430,000 sq ft, reflecting strategic relocations and space consolidation by occupiers. Correspondingly, vacancy rates declined across all submarkets, registering 18.6% in the city centre, 6.7% in the fringe, and 22% in decentralised locations.

Conversely, older properties and those situated in less central or less sought-after locations are likely to encounter persistent competitive challenges. Landlords in these segments may need to invest in upgrades, reconfigure spaces, or introduce more adaptable leasing options to meet the ongoing demand for high-quality office environments, Lee said.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.