- The bulk of overhang across key states in the recent months was made up of the mid-range, and even condo units which are considered within the affordable price brackets, i.e. between RM200,000 and RM600,000.

PETALING JAYA (Sept 29): Malaysia’s housing overhang wasn’t blowing up in numbers, but it was shifting.

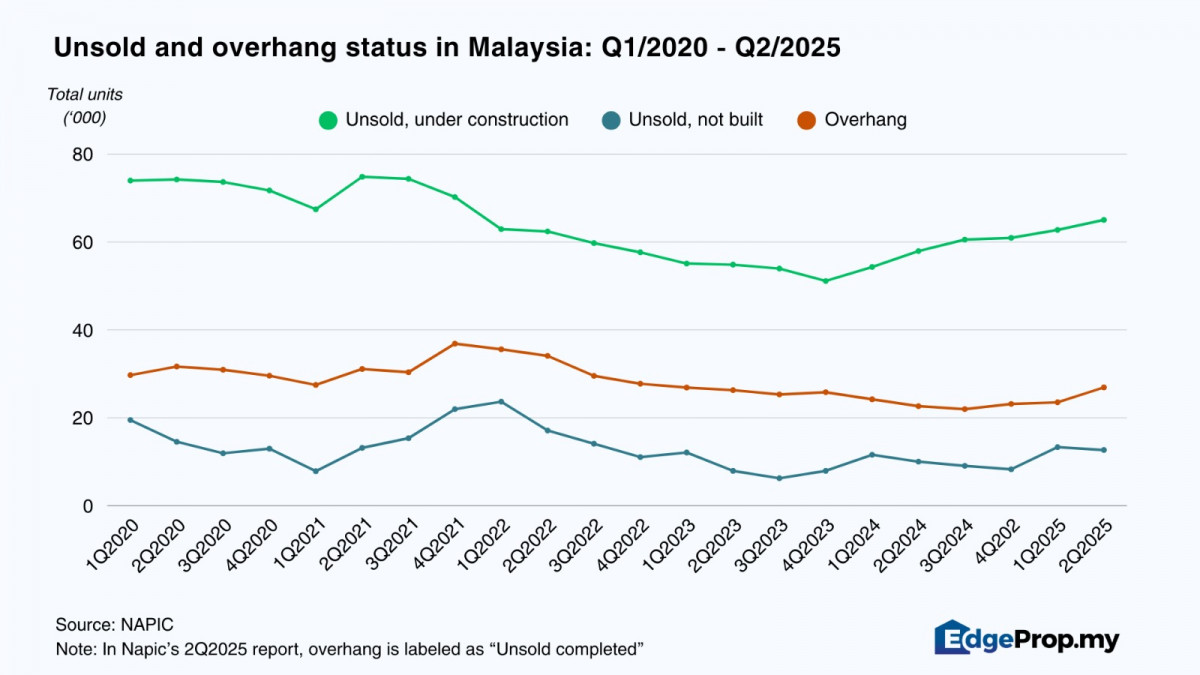

According to the National Property Information Centre (Napic)’s report, 1Q2025 recorded 23,515 units of unsold completed homes. Compared to 24,208 units in 1Q2024 and 26,872 in 1Q2023, the numbers had actually tapered down, but the real story is where the overhang sat.

Instead of coming from the high-end segment, the bulk of overhang across key states in the recent months was made up of the mid-range, and even condo units which are considered within the affordable price brackets, i.e. between RM200,000 and RM600,000.

(It is worth noting that Napic used to define overhang as units that have remained unsold for nine months and above after obtaining their certificates of completion and compliance (CCC). However, such a distinction seems to be absent in the 2023–1Q2025 Napic reports, whereby overhang and unsold completed units (possibly even those below nine months) are used interchangeably.)

By state, the trends are clearer:

Kuala Lumpur: Overhang was shifting to lower-priced markets. In 2023 and 2024, the RM500,001–RM600,000 condo segment topped the list with 788 and 819 units out of 3,423 and 3,194 in total respectively. By 1Q2025, the bulk moved to the RM200,001–RM300,000 range, with 880 units overhung out of 3,668 units in total, showing even “cheaper” KL condos were struggling. However, these might comprise small or studio units, whose psf price might not necessarily be “cheap”, and whose supply had likely exceeded demand.

Selangor: High-end condos headed the list. In 2023 with 1,026 units, and 2024 with 984 units, where overhang units consisted of the RM1 million+ segment. By 1Q2025, the spotlight shifted to RM500,001–RM600,000 condos (292 units), but luxury remained sticky, at 132 units, out of 2,068 overhang units in total.

Johor: The pressure on mid-range persisted. Unsold condos in the RM500,001–RM600,000 range dropped from 792 in 2023 to 425 out of 3,034 total overhang units in 1Q2025, but absorption is slow because of Johor’s heavy pipeline of new supply.

Penang: Overhang cut across both affordable and luxury brackets, with different price segments emerging tops in different years. In 1Q2023, 482 condo units sat in the RM300,001–RM400,000 band. By 2024, over 500 condo units priced RM1 million+ were added, and in 1Q2025, even RM200,001–RM300,000 condo units (470) were piling up, from a total overhang of 2,729 units.

Nationally, the price trend is telling:

- 2023: Overhang was heaviest at RM500,001–RM600,000 condos (2,955 units).

- 2024: Pressure shifted to RM300,001–RM400,000 condos (3,039 units).

- 1Q2025: The same band (RM300,001–RM400,000 condos) stayed dominant (2,715 units), while RM200,001–RM300,000 condos also picked up with 2,336 units.

The chart below shows national overhang dipping in 2024 before slightly climbing again in 1H2025, which was probably a reflection of fresh supply landing in already saturated price ranges.

In short, Malaysia’s total overhang isn’t spiralling, but the consistent build-up of mid-market and “affordable” condos in KL, Selangor, Johor and Penang appears to highlight a mismatch. On paper, these projects are priced for demand, but in reality, buyers don’t seem to be biting.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.