- FRSB is currently constructing a four-storey workers’ hostel and a guard house on the site. Ornapaper said the acquisition is intended to provide accommodation for its foreign workers.

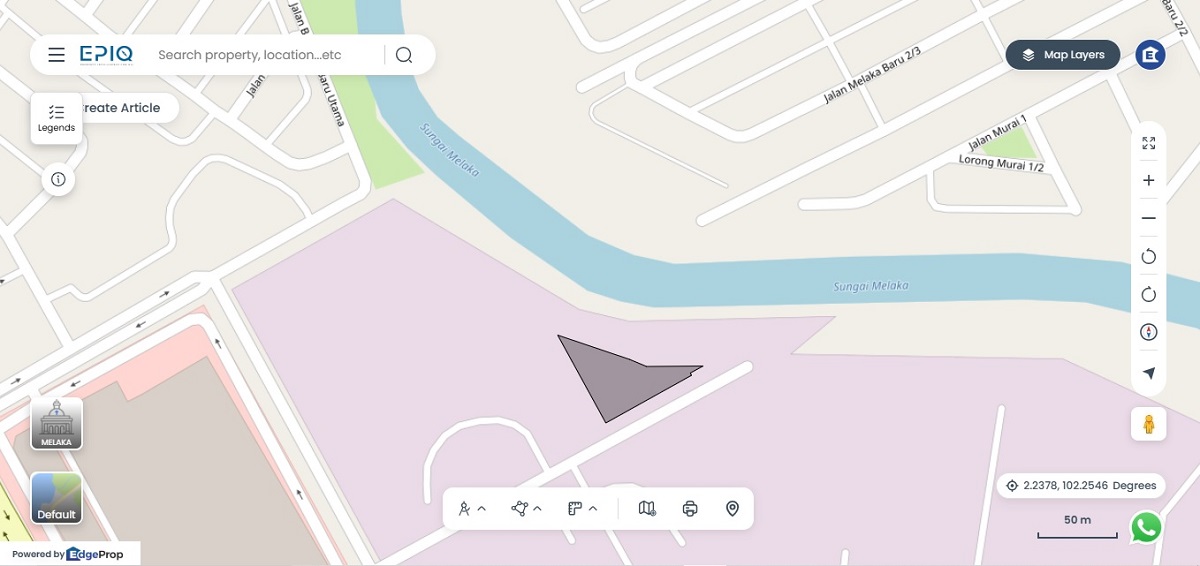

KUALA LUMPUR (Oct 3): Ornapaper Bhd, one of the country’s largest manufacturers of corrugated boards and cartons, has proposed to acquire two leasehold parcels of vacant land in Melaka for RM7.2 million. Both come with a remaining tenure of about 98 years, together with an ongoing building project from Fairway Review Sdn Bhd (FRSB).

In a bourse filing on Thursday, the company said its wholly-owned subsidiary, Ornapaper Industry (M) Sdn Bhd, has entered into a sale and purchase agreement with FRSB for the land and buildings.

The two parcels, collectively measuring 20,259 sq ft, have leaseholds that will expire on Oct 17, 2123. FRSB is currently constructing a four-storey workers’ hostel and a guard house on the site.

According to Ornapaper, the acquisition is intended to provide accommodation for its foreign workers.

The project is expected to be completed by the third quarter of 2026 and will be financed through a combination of internal funds and bank borrowings.

The company added that the acquisition is not expected to have any material impact on its earnings or earnings per share for the financial year ending Dec 31, 2025.

FRSB’s shareholders are listed as Sai Han Siong and Sai Swee Seong, each holding 250,000 shares or 50% of the company.

Ornapaper disclosed that certain directors and major shareholders have interests in the proposed acquisition. Sai Ah Sai, a director and major shareholder of Ornapaper, is also a director of Fairway Review Sdn Bhd (FRSB).

His son, Sai Han Siong, who is likewise a director and major shareholder of Ornapaper, is also a director and substantial shareholder of FRSB.

In addition, Sai Swee Seong, the elder brother of Sai Han Siong, is a director and substantial shareholder of FRSB. As a result, Sai Ah Sai and Sai Han Siong are deemed interested directors and have abstained, and will continue to abstain, from all deliberations and voting on the proposed acquisition at the relevant board meetings.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.