- Sunway REIT said the sale is part of its ongoing capital recycling strategy to optimise portfolio quality and long-term value creation.

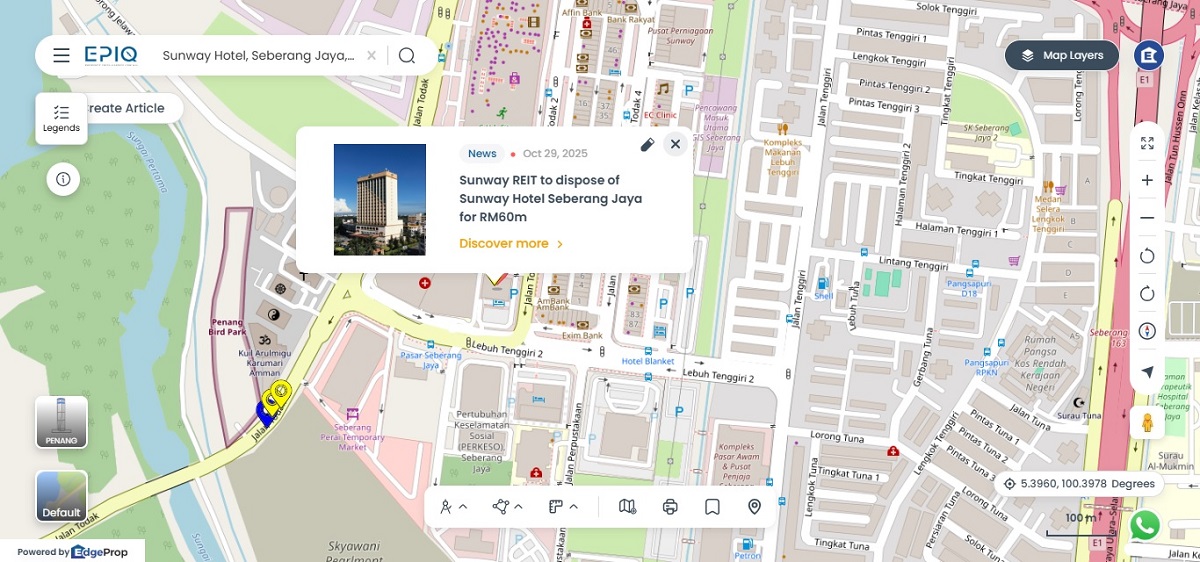

PETALING JAYA (Oct 29): Sunway Real Estate Investment Trust (REIT), through its trustee RHB Trustees Bhd, has entered into a conditional sale and purchase agreement (SPA) with Sunway Medical Centre Penang Sdn Bhd for the disposal of the Sunway Hotel Seberang Jaya property in Penang for a total cash consideration of RM60 million.

In a bourse filing on Tuesday, the proposed disposal involves the transfer of a 4,294 sq m leasehold parcel of land and the 27-year-old hotel building erected on it, along with all related fixtures, fittings, and equipment.

Sunway REIT said the sale is part of its ongoing capital recycling strategy to optimise portfolio quality and long-term value creation.

Proceeds from the disposal will be used to fund the development of a new hotel atop Sunway Carnival Mall, scheduled for completion in the fourth quarter of 2027.

The upcoming hotel will feature enhanced facilities such as a larger ballroom, an infinity pool, and direct connectivity to the mall.

Of the RM60 million in gross proceeds, RM59.5 million will be allocated for property development activities, while RM500,000 will be set aside for related professional fees and expenses. Pending utilisation, the proceeds will be placed in interest-bearing deposits or used for loan repayment.

The disposal is not expected to materially impact Sunway REIT’s net asset value or gearing ratio. Based on pro forma figures, its gearing level is projected to remain stable at 37.8% following the completion of both the Sunway University disposal and this transaction.

According to the announcement, Sunway Medical Centre is a wholly-owned subsidiary of Sunway Healthcare Holdings Bhd, which is 84%-owned by Sunway City Sdn Bhd, a wholly-owned subsidiary of Sunway Bhd.

The transaction is deemed a related party transaction under Bursa Malaysia listing requirements due to cross-shareholding and directorship interests within the Sunway group.

Knight Frank Malaysia Sdn Bhd appraised the property at RM55 million as of July 17, 2025, with the sale price representing a 9.1% premium above market value. Sunway REIT expects to record a gross disposal gain of RM4 million, excluding incidental costs.

The property, which was acquired by Sunway REIT in July 2010 for RM51.9 million, is currently fully leased to Sunway Hotel (Seberang Jaya) Sdn Bhd under a master lease agreement that will be terminated upon completion of the disposal.

The Audit Committee and Board of Sunway REIT Management Sdn Bhd, the REIT’s manager, have both concluded that the disposal is in the best interest of the trust and its unitholders. The trustee, RHB Trustees, has also granted its approval.

Barring unforeseen circumstances, the group is of the view that the transaction is expected to be completed by 4Q2027.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.