- Johor's overall residential market continued to show exceptional growth. Its steep climb upwards outperformed Selangor, Kuala Lumpur, and Penang, distinguishing it from the national trend.

KUALA LUMPUR (Nov 7): Johor recorded the strongest property price growth in the third quarter of 2025 (3Q2025), driven by notable increases in both serviced apartment and landed home values compared with 2024.

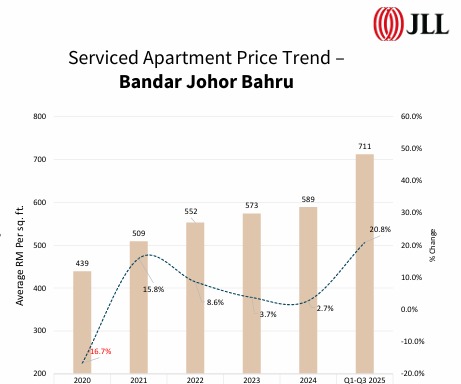

Average transaction price for serviced apartments surged by 20.8% from RM549 per square foot (psf) in 2024 to RM711 psf in 2025, said JLL Malaysia managing director Jamie Tan at the firm’s 3Q2025 market briefing on Tuesday.

This was generated by the launching of many high-end offerings in the market, he explained.

Meanwhile, landed home prices in Johor Bahru rose by 10.2%, from RM352 psf in 2024 to RM388 psf in 3Q2025.

Read also

Malaysia to become one of Asia Pacific’s biggest data centre markets—JLL Malaysia

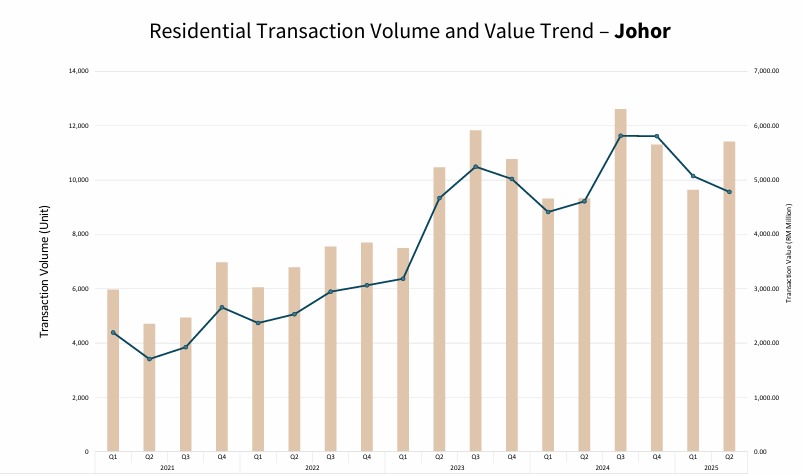

Further, Johor's overall residential market continued to show exceptional growth. Its steep climb upwards outperformed Selangor, Kuala Lumpur, and Penang, distinguishing it from the national trend.

Johor’s residential property market strengthened between 2021 and 2025, with transaction volumes rising from about 6,000 units in 1Q2021 to a peak of 12,500 units in 3Q2024, while transaction values climbed from below RM2.5 billion to RM5.8 billion over the same period before moderating to RM4.8 billion in 2Q2025.

The southern state’s robust growth in the residential market was driven by the strategic development of the Johor-Singapore Special Economic Zone (JS-SEZ) and comprehensive infrastructural transformation initiatives across the state, along with positive spillover effects from rising industrial and data centre investments.

KL prime residences stable but office sector muted

In Kuala Lumpur, demand for prime residences remains resilient, supported by both local and foreign buyers.

The government’s decision to double the Housing Credit Guarantee Scheme to RM20 billion and extend stamp duty relief further underpins stability in this segment.

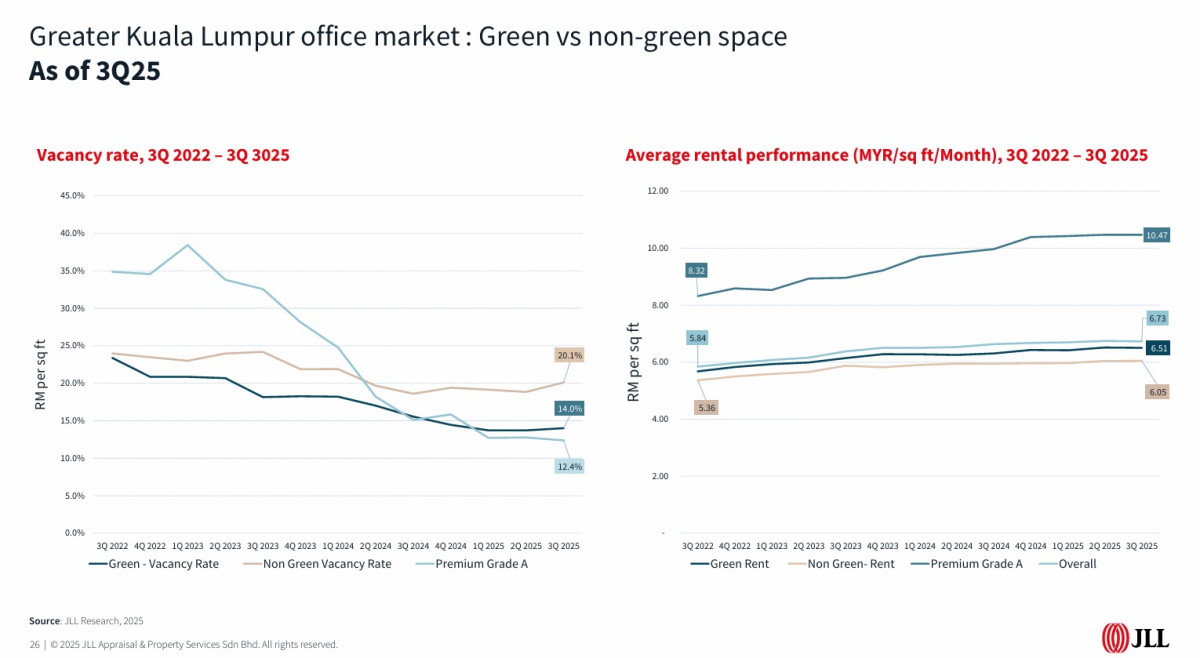

The office sector, however, remains subdued despite a marginally positive net absorption rate. JLL Malaysia’s head of office leasing advisory Quiny Lee said the “flight to quality” trend continues as occupiers shift towards newer, Grade-A green-certified buildings, leading to a slight uptick in overall vacancy rates following new completions.

Lee also revealed that green rental rates increased to RM10.47 psf in 3Q2025, from RM8.32 psf in 3Q2022. In comparison, non-green rental rates were lower, but rose from RM5.36 psf in 3Q2022 to RM6.05 psf in 3Q2025.

Industrial segment moderates

Meanwhile, demand in the industrial sector moderated in 3Q2025, with JLL attributing the slowdown to market uncertainties arising from higher US tariffs and the expansion of the sales and service tax (SST). These factors have prompted companies to adopt a more cautious and cost-conscious stance, leading to lower net absorption.

“New supply addition maintains market health despite rising vacancy rate of 6.3% for 3Q2025," said JLL Malaysia logistics and industrial senior manager Derek Yap.

Nevertheless, overall, Malaysia’s property market continued to show resilience in 3Q2025, with the residential segment maintaining stability and demand for industrial and data centre assets continuing to expand, Tan said.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.