- With the deal being voted down, Turiya said, in a separate filing, it will sell its entire stake in property arm Turiya Properties Sdn Bhd, which was meant to buy Wisma Sentral Inai, to Shamir for RM0.1 million.

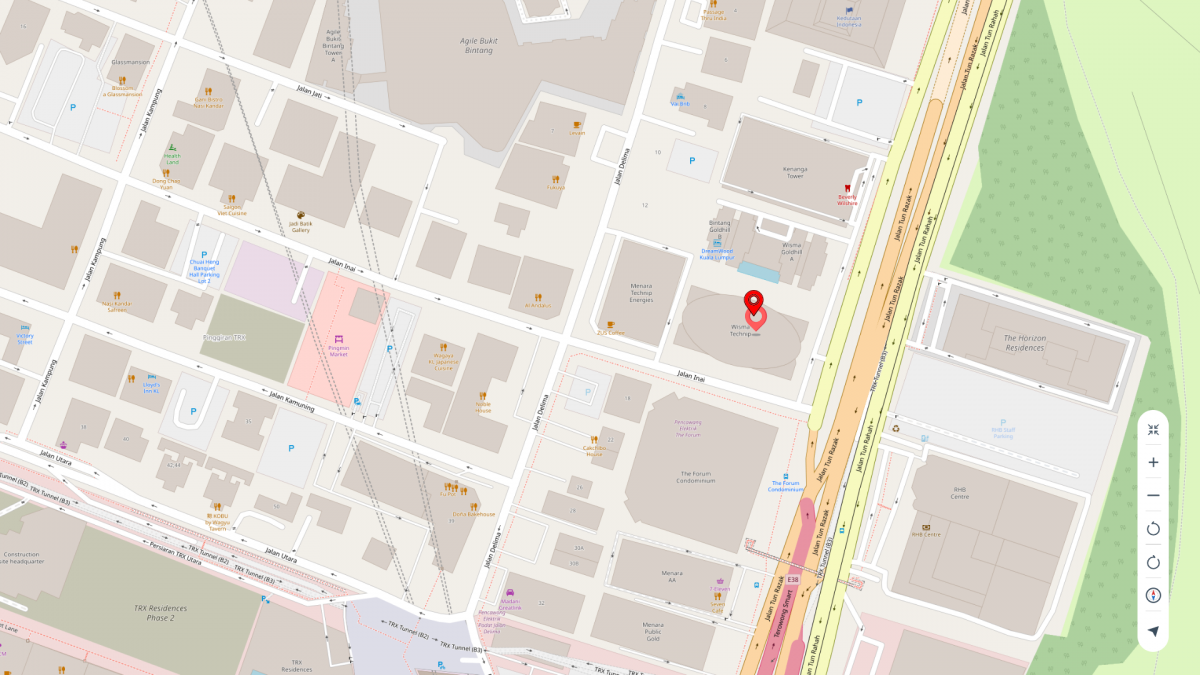

KUALA LUMPUR (Dec 15): Shareholders of Turiya Bhd (KL:TURIYA) have blocked the company’s proposed acquisition of the 12-storey Wisma Sentral Inai in Kuala Lumpur for RM135 million, a deal that was to be funded via a cash injection from its executive chairman, Datuk Seri Shamir Kumar Nandy.

The minority shareholders representing 20.19 million shares, or 95.9% of total votes, rejected two resolutions, namely the purchase of Wisma Sentral and issue of redeemable preference shares to fund the acquisition at an extraordinary general meeting held on Monday, according to the company’s filing with the bourse.

With the deal being voted down, Turiya said, in a separate filing, it will sell its entire stake in property arm Turiya Properties Sdn Bhd, which was meant to buy Wisma Sentral Inai, to Shamir for RM0.1 million. After the sale, Shamir will complete the acquisition on his own. The sale has little financial impact, as Turiya Properties has no operations or significant assets and needs no approvals.

The company said the disposal price reflects Turiya Properties’ unaudited net assets as of Nov 30, 2025.

Turiya announced in August its plan to purchase the 31-year-old office building from Sentral REIT (KL:SENTRAL), citing the move as a way to boost revenue, attract tenants quickly, and diversify income beyond its semiconductor business.

To finance the deal, Turiya Properties entered into a conditional subscription agreement with Shamir, who was to inject RM135 million by subscribing to 135 million redeemable preference shares at RM1 each. The injection was intended as interim funding while the group secured longer-term financing.

According to the company’s balance sheet as at Sept 30, Shamir made prepayment of RM125 million in October while pending shareholder approval on the proposed issue of redeemable preference shares.

The prepayment will be refunded to Shamir, according to the variation letter that Turiya signed with him on Oct 23.

Turiya’s plan was to fund the acquisition through a mix of bank borrowings and internal resources, noting that full bank financing could take time due to ongoing negotiations.

Shamir’s subscription was meant to bridge this gap, enabling the purchase to proceed, Turiya said in the bourse filing. The group later intended to redeem the preference shares using more stable financing options such as term loans, internally generated funds, or new securities issuance.

Shamir holds an effective 10% stake in cash trust company UBB Amanah.

Over the last five years, Turiya has posted paltry profits. Its highest net profit during the period was recorded in the financial year ended March 31, 2023 (FY2023)—RM4.08 million on the back of RM28.54 million in revenue.

For the first quarter ended Sept 30, 2025 (1QFY2026), the group reported a net profit of RM1.14 million on revenue of RM7.63 million.

It also reported paying RM13.5 million in earnest deposits for the Wisma Sentral Inai acquisition while also recording RM125 million in prepayments—both reflected under cash balances and prepayment liabilities.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.