KUALA LUMPUR (Jan 14): Shares of Sunway Bhd (KL:SUNWAY) and IJM Corporation Bhd (KL:IJM) ended Tuesday on a mixed note as investors weighed Sunway's proposed RM11 billion cash-and-share takeover of IJM against the group’s upcoming healthcare listing.

IJM’s shares settled one sen or 0.36% lower at RM2.74, valuing the construction group at RM9.99 billion. The stock initially climbed to a four-month high of RM2.97 before easing after analysts flagged that the RM3.15 offer price implied a less compelling valuation than originally perceived.

Sunway’s shares, meanwhile, rose five sen or 0.89% to RM5.65, giving the group a market capitalisation of RM38.45 billion. The counter touched an intraday high of RM5.71 before paring gains.

Year to date, IJM’s share price is still up 47 sen or nearly 21%, while Sunway’s shares have more than doubled since early 2024.

The offer structure

Under the proposal, Sunway is offering RM3.15 per IJM share through a combination of RM0.315 in cash and 0.501 new Sunway shares, valuing IJM at about RM11 billion. This means that for every 1,000 IJM shares held, shareholders would receive RM315 in cash and 501 Sunway shares worth RM2,835, based on Sunway’s issue price of RM5.65.

However, the "math" of the deal is complicated by Sunway's plan to list its healthcare arm, Sunway Healthcare Holdings Bhd, on Bursa Malaysia.

Sunway intends to distribute 676.04 million Sunway Healthcare shares to existing shareholders via a dividend-in-specie, based on one Sunway Healthcare share for every 10 Sunway shares held, with the entitlement date to be determined. Post-listing, Sunway’s effective stake in Sunway Healthcare will be diluted from 84% to nearly 70%.

The timing gap

A Jan 2 note from Hong Leong Investment Bank Research estimated this dividend-in-specie to be worth about 18 sen per Sunway share. Once Sunway shares trade ex-dividend, the share price is expected to adjust downward to reflect this distribution.

However, the new Sunway shares issued as consideration to IJM shareholders will not be entitled to this healthcare distribution due to "timing differences", as Sunway president Datuk Anuar Taib put it during a press conference on Monday.

This gives rise to concerns that the healthcare spin-off reduces the effective value of the IJM offer. But analysts contacted by The Edge said they expect no adjustment to the issue price of RM5.65 and the number of consideration shares. The Edge has reached out to Sunway for comments. The group has yet to respond at press time.

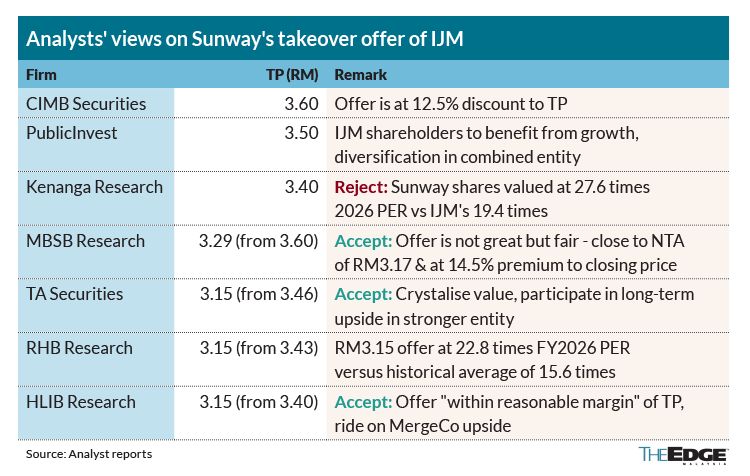

Not all market observers are convinced of the deal's merits. Kenanga Research has advised IJM shareholders to reject the offer, arguing that it falls below its RM3.40 target price and that the share-swap component overvalues Sunway.

Kenanga noted that at the issue price, Sunway is valued at a 2026 price-earnings (PE) ratio of 27.6 times, compared to the 19.4 times implied by the RM3.15 offer for IJM. Based on Kenanga's target price of RM4.73 for Sunway, they calculated that the "implied value" of the offer for IJM was just RM2.69—below Kenanga's target price of RM3.40 for IJM and its last traded price of RM2.75 prior to the announcement.

While the offer is below most analysts' target prices for IJM (see table), a number of them have recommended that shareholders accept the offer, citing the opportunity to crystalise IJM's value and ride the long-term upside through participation in the enlarged Sunway group.

TA Securities noted that the offer price values IJM above historical averages and allows shareholders to "monetise IJM at a fair multiple" without waiting for a sector re-rating.

At RM5.65 per consideration share, the offer structure appears advantageous to Sunway, a corporate adviser noted. "As to whether it's fair, it's ultimately up to shareholders, whether they see value in the deal, based on their own risk appetite," the adviser said.

On the other hand, it is an opportunity for IJM shareholders to own a bigger entity that is listed on the KLCI, one fund manager said. “KLCI component stocks command a huge [valuation] premium” and are more attractive to potential buyers versus non-KLCI stocks, the fund manager noted.

The takeover offer is conditional upon Sunway obtaining a 50% stake in IJM. Sunway does not intend to maintain the listing status of IJM if its shareholding reaches 75% and will invoke compulsory acquisition rights once its control crosses the 90% threshold.

The Employee Provident Fund is IJM's largest shareholder with an 18.4% stake. It also holds an 8.75% stake in Sunway. Both groups operate in overlapping sectors—construction and property development—but the acquisition would provide Sunway with a strategic foothold in toll concessions.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.