KUALA LUMPUR (Jan 15): Construction outfit SC Estate Builder Bhd (KL:SCBUILD) has formalised an agreement to acquire a 25% equity interest in a non-operational hotel in Alor Setar for RM18.79 million from chairman Loh Boon Ginn’s mother in its push into property investment. Boon Ginn is also managing director cum chief executive officer of SC Estate Builder. The purchase price will be settled via the issuance of redeemable convertible preference shares (RCPS).

In a bourse filing on Thursday, SC Estate Builder said it had entered into a share sale agreement with Koay Seok Chin for the acquisition of 20 million shares in Sentosa Club Hotel Sdn Bhd.

Koay, the sole shareholder, is also the mother of SC Estate Builder’s executive directors Shy Tyug and Shy Ming, as well as the mother-in-law of deputy executive chairman Kuay Jeaneve. Another member of the Loh family, Shy Huey is a director in Sentosa Club.

The transaction is deemed a related-party transaction.

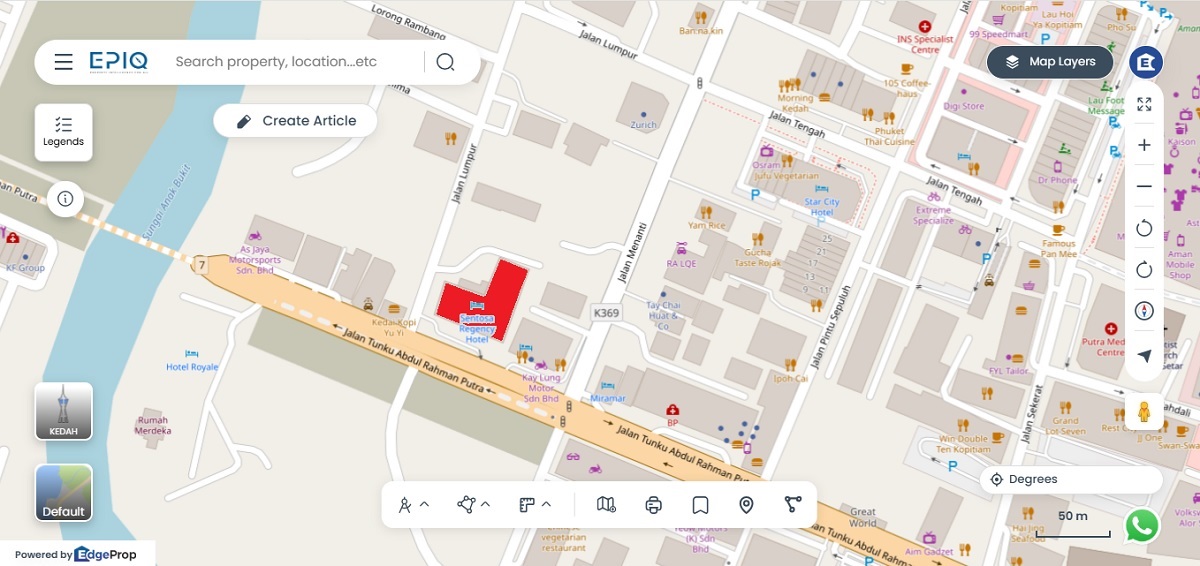

According to SC Estate Builder, Sentosa owns a parcel of commercial land with a seven-storey hotel building comprising 86 rooms at Jalan Putra in Alor Setar. The hotel, known as Sentosa Regency Hotel, however, has ceased operations since 2021 as a result of the Covid-19 pandemic.

SC Estate Builder said the proposed acquisition will allow the group to repurpose part of the building for use as its head office, while converting the remaining space into offices for rental, enabling it to venture into the property investment business and generate rental income.

The RM18.79 million purchase consideration will be satisfied through the issuance of up to 1.88 billion new RCPS at an issue price of one sen each.

Upon full conversion of the RCPS, SC Estate Builder’s largest shareholder Tan Chai Leng’s stake would be diluted to 14% from 19%, while Chuai Ai Mai’s shareholding would be reduced to 9% from 12%. Another substantial shareholder, Cheng Lai Hock, would see his stake fall to 4.97% from 6.73%, below the 5% threshold to remain a substantial shareholder.

Tan holds his shares via Vantage Matrix Sdn Bhd, Chuai via SC Estate World Sdn Bhd, and Cheng via Takzim Empayar Sdn Bhd.

The proposals are subject to approvals from Bursa Malaysia Securities, shareholders at an extraordinary general meeting, and any other relevant regulatory or third-party approvals, where required.

SC Estate Builder said applications to the relevant authorities will be submitted within two months, and barring unforeseen circumstances, the proposals are expected to be completed in the second half of 2026.

At the time of writing, SC Estate Builder shares were up half a sen to one sen, valuing the group at RM53.2 million.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

.jpg?KpT57Dw7Y_UzSKH8HsHP9pRQ_peOr_KV)