KUALA LUMPUR (Jan 15): SkyGate Solutions Bhd (KL:SKYGATE) is buying a Penang-based property investment company linked to its major shareholder for RM75.9 million in cash and shares.

Its unit, SkyGate Properties Sdn Bhd, inked a sale and purchase agreement with Dahlia Cemerlang Sdn Bhd’s shareholders, Jitu Sempurna Sdn Bhd, Prominent Goldhill Sdn Bhd and Promaddun Sdn Bhd, to acquire the entire equity interest in the company, according to a bourse filing on Thursday.

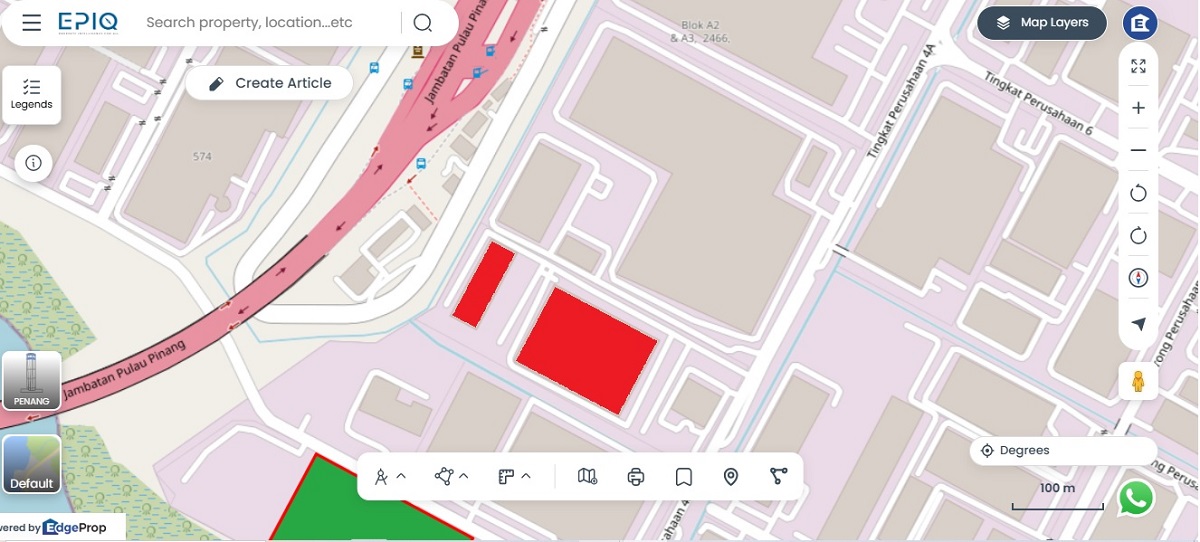

SkyGate is buying Dahlia Cemerlang to add an 8.15-acre industrial property within the Perai Industrial Park in Penang to its property portfolio. Over half of the property is tenanted and brings in rental income of about RM5.3 million per year, it noted.

"The proposed acquisition represents a strategic investment by SkyGate and is consistent with the group’s long-term strategy to expand and strengthen its investment properties portfolio with income-generating assets located in established growth regions,” it said.

The purchase will be settled via RM53.1 million in cash and 33.27 million SkyGate shares—representing 9.04% of its enlarged share base — issued at 68.54 sen apiece, being the five-day volume-weighted average price of SkyGate shares up to Wednesday (Jan 14).

Meanwhile, the RM75.9 million price tag on Dahlia Cemerlang is based on its adjusted net assets of RM75.91 million. The adjustment accounts for a net revaluation surplus after valuer, CBRE WTW Valuation & Advisory Sdn Bhd, ascribed a fair market value of RM82 million on the Seberang Perai property on Thursday.

Looking at Dahlia Cemerlang’s current shareholders, two are linked to SkyGate’s major shareholder, Datuk Ooi Eng Leong. Dahlia Cemerlang is 46%-owned by Jitu Sempurna, while Prominent Goldhill holds 30%, and Promaddun with 24%.

Eng Leong owns a 50% stake in Jitu Sempurna, while the remaining half is held by SkyGate executive director, chief executive officer and substantial shareholder Goh Kiang Teng.

Prominent Goldhill is 45% owned by Hong (L) Foundation, the family foundation of Datuk Seri Hong Yeam Wah, 30% by Datuk Yong Chai Seng, Kok Hwa Cheah (15%) and Datuk Ooi Kok Kee (10%).

Hong, a 4.4% shareholder in SkyGate, together with Goh, acted in concert with Eng Leong in a mandatory takeover offer for SkyGate, then known as Ewein Bhd, back in June 2023. As for Promaddun, it is equally owned by Lim Hwa Choon and Loo Bing Oat.

SkyGate will seek non-interested shareholders’ nod for the deal at an extraordinary general meeting to be convened. Given its related-party nature, SCS Global Advisory (M) Sdn Bhd has been appointed to advise non-interested directors and shareholders.

The group expects to complete the acquisition in the second half of 2026. It will see Eng Leong’s stake in SkyGate fall to 39.02% from 40.61% currently, while Goh’s will rise to 6.7% from 5.08%.

Shares in SkyGate ended unchanged at 73 sen, valuing the company at RM245.14 million.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.

.jpg?KpT57Dw7Y_UzSKH8HsHP9pRQ_peOr_KV)