PUTRAJAYA (Feb 12): In a landmark judgement last week involving a property development project in Penang, the Court of Appeal (COA) ruled that for mixed developments, a single joint management body (JMB) should operate, and there should not be different managements for commercial and residential properties in the running of maintenance and management of the development.

The COA also held that there could be different rates imposed on residential and commercial properties on the said project.

The decision concerns the interpretation with regard to the validity of a bifurcated management structure in a mixed development under the Building and Common Property (Maintenance and Management) Act 2007 (BCPA 2007) and the Strata Management Act 2013 (SMA 2013). The BCPA was repealed in 2015.

On Feb 3, the three-member COA bench also ruled that the developer, Hunza Properties (Gurney) Sdn Bhd—a wholly owned subsidiary of Hunza Properties Bhd—and the proprietor, Hunza Properties (Penang) Sdn Bhd, are to hand over the management of the common property to the JMB by providing documentation for proper management.

The bench, led by COA judge Datuk Azhahari Kamal Ramli, also ordered that an annual general meeting (AGM) be convened soon to decide the different rates to be imposed on different components of the property which have different purposes, notwithstanding that the development is still within the JMB period.

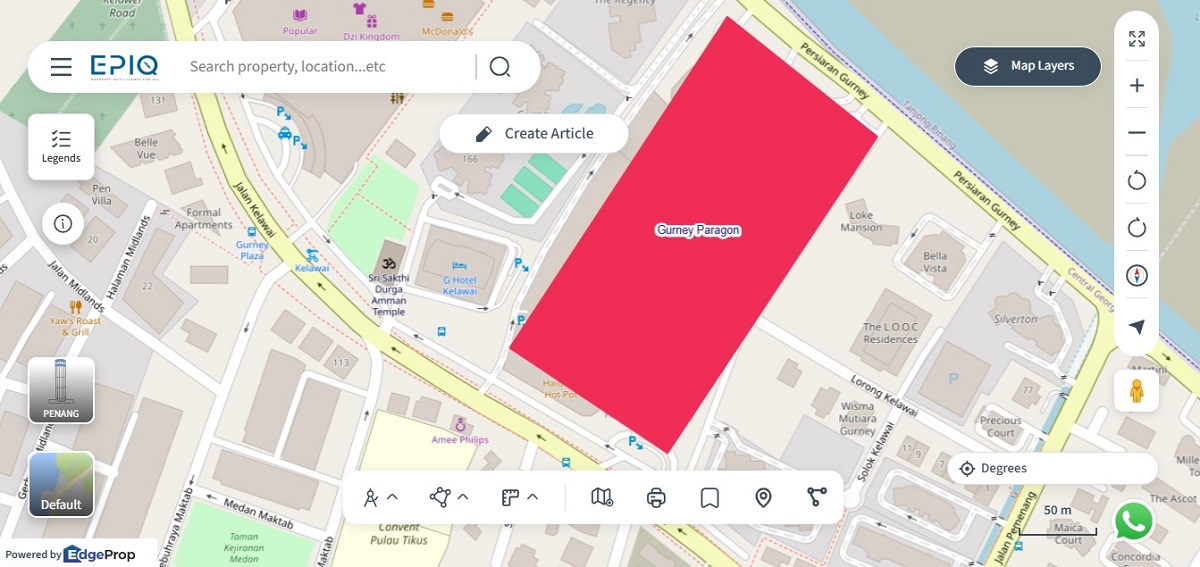

The property in question is Gurney Paragon, a mixed-development property with two residential tower blocks with 220 units, an office tower block, a block of the Gurney Paragon shopping mall with a retail podium, a St Jo’s heritage building, and a retail car park.

In 2014, at the first AGM of the Gurney Paragon residential JMB, resolutions were passed to separate management and maintenance for the residential and commercial components and establish separate maintenance funds for residential owners and allow commercial owners to manage their own funds.

These resolutions are consistent with the sale and purchase agreements (SPAs) entered into between relevant purchasers and Hunza Properties (Gurney) and Hunza Properties (Penang) between 2007 and 2012, which expressly stipulate the separation of the residential and commercial components.

It is to be noted that under the BCPA, it is stipulated that a project development should have only one JMB, and the SMA also says that there should be one account for maintenance and sinking funds.

Legal proceedings commenced in 2017

However, sometime in 2017, the JMB’s solicitors commenced proceedings at the High Court claiming RM56.930 million in arrears of maintenance charges and sinking fund contributions against the two companies and sought an order for the respondents to return the commercial common property.

This follows the JMB having written to the commissioner of buildings (COB) alleging that Hunza Properties (Gurney) had failed to pay the charges into the building maintenance account and contribute to sinking funds of the JMB, pursuant to Sections 12 and 15 of the SMA 2013.

It should be noted that the SMA stipulates that the developer shall open one account for maintenance and also one account for sinking funds.

However, the Penang High Court had upheld that there should be a separate management of the residential and commercial properties as per the resolution of the first AGM, where the judge held that it was neither “just and reasonable” nor “fair and justifiable” for the JMB to impose charges determined solely by residential parcel owners upon the commercial proprietors.

This allowed Hunza Properties (Gurney) and Hunza Properties (Penang) to maintain their own funds.

Proceedings in COA

Following the High Court’s decision, the Gurney Paragon residential JMB appealed to the COA, and last week COA judge Datuk Ong Chee Kwan, who wrote the unanimous decision in sitting with Azhahari and Datuk Ahmad Kamal Md Shahid, in allowing the JMB’s appeal in principle, held that separate managements are not permitted within a single development.

Ong further held that the resolutions held in the first AGM and the COB’s decision to allow separate managements for residential and commercial property as null and void as they contravene the provisions under the BCPA 2007 and SMA 2013.

“The bench takes the view that the purported majority controlled by the residents cannot be a valid reason to avoid convening a general meeting to vote,” the judge said.

“The High Court had erred in allowing separate management structures as the statutory framework (legislation) requires a unified approach to property management.”

Ong held the resolutions passed in the first AGM—that different management could manage the residential and commercial properties, and the two companies as developers cannot maintain separate building maintenance accounts for commercial components.

“The two companies are the developer and the original proprietor parcel owner and not a management body; and therefore [they] are not allowed to open and maintain a building maintenance account and sinking fund account for commercial purposes. Any resolutions seeking to vest in the two companies such powers are ultra vires of the BCPA 2007 and SMA 2013 and treated as null and void.”

However, the appellate bench did not allow the JMB’s monetary claim and accepted the developers’ position that a proper general meeting be convened with the attendance of all residential and commercial owners to determine the charges imposed.

The two companies are only liable to pay for the charges retrospectively until the rates are determined at the general meeting.

In allowing different rates for residential and commercial properties, the appellate court held that the wording of Section 17(1)(b) of the BCPA 2007 and Section 10(3)(b) of the SMA 2013 are capable of being interpreted to permit the imposition of different rates of charges for different rights of use of common property within a mixed development.

“In other words, the wordings in Section 17(1)(b) of the BCPA 2007 and Section 10(3)(b) of the SMA 2013 are capable of being interpreted to permit the imposition of different rates of charges for different rights of use of common property within a mixed development,” Ong ruled.

Final decision

Following this, the appellate court set aside the High Court’s decision and ordered the declaration that the resolutions in the first AGM be declared ultra vires and void.

It also directed the JMB to convene an AGM as soon as practicable to be attended by all the parcel owners, comprising both the residents and commercial component to present a proper budget in respect of all the common property of Gurney Paragon.

In the proceedings, the JMB were represented by Lai Chee Hoe, Deyvinah Ganesalingam, and Low Yen Hau from Messrs Chee Hoe & Associates, while Ashok Kumar Madadev Ranai and Lim Chin Lun from Messrs Skrine acted for the respondents.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.