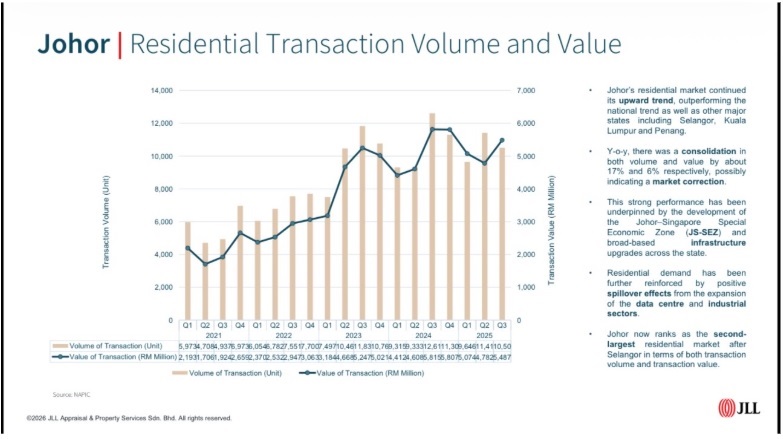

KUALA LUMPUR (Jan 30): Johor has established itself as Malaysia’s second-largest residential market in 2025, following Selangor, based on both transaction volume and value. In the third quarter, Johor recorded 10,500 transactions with a total value of RM5,487 million.

The southern state sustained positive momentum, outperforming the national trend as well as other key markets. For comparison, Selangor reported 14,560 transactions worth RM8,466 million, Kuala Lumpur had 3,789 transactions valued at RM3,452 million, and Penang recorded 4,614 transactions totaling RM2,128 million in the same period.

Johor’s performance has been supported by the development of the Johor–Singapore Special Economic Zone (JS-SEZ), alongside broad-based infrastructure upgrades, said JLL Malaysia managing director, and head of value and risk advisory Jamie Tan in its 4Q2025 property market media presentation here on Tuesday.

Residential demand has also been bolstered by spillover effects arising from the expansion of the data centre and industrial sectors, Tan added.

However, on a year-on-year (y-o-y) basis, both transaction volume and value saw consolidation of approximately 17% and 6% respectively, which may suggest a period of market correction.

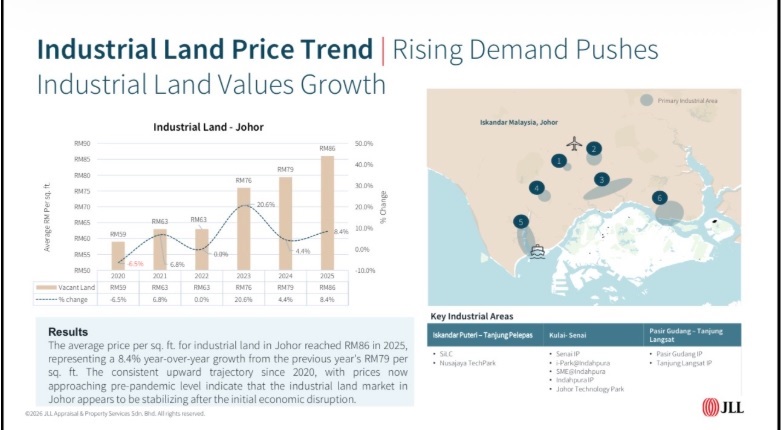

Industrial land prices in Johor continue upward trend

Meanwhile, industrial land values in Johor have continued to rise, driven by sustained demand across key areas including Iskandar Puteri–Tanjung Pelepas, and Kulai–Senai.

JLL Malaysia logistics and industrial senior manager Derek Yap said that the average price psf reached RM86 in 2025, marking an 8.4% y-o-y increase from RM79 in 2024. This consistent growth since 2020, approaching pre-pandemic levels, suggests the market is stabilising following earlier economic disruptions.

Major industrial zones such as SiLC (Southern Industrial and Logistics Clusters) Nusajaya, Nusajaya TechPark, Senai IP, i-Park@Indahpura, SME@Indahpura, Indahpura IP, Johor Technology Park, Pasir Gudang IP, and Tanjung Langsat IP continue to attract occupiers across sectors including electrical and electronics (E&E), logistics, automotive, data centre-related supply chains, medical, and fast-moving consumer goods (FMCG).

Yap added that the market benefits from investor-friendly policies, strategic positioning, and regional diversification strategies, including the China Plus One approach.

While rental growth is expected to remain modest in 2026 because of substantial new supply, landlords are offering enhanced incentives and concessions, reflecting a competitive environment. Warehouse and factory space continue to be in demand, with vacancy rates low across key hotspots.

Local institutions and Malaysian REITs remain the dominant players, strategically acquiring high-quality assets in prime locations to strengthen and diversify logistics portfolios despite ongoing economic uncertainties.

Nusajaya becoming prime data centre hub

On data centres, JLL Malaysia capital markets manager Sum Chun Kit shared that Nusajaya has emerged as a premium data centre destination in Johor, strategically located near Singapore via the Tuas Second Link.

Meanwhile, Sedenak is home to one of Southeast Asia’s largest purpose-built data centre parks, featuring dedicated power and water infrastructure—with Phase 1 now fully operational, and Phase 2 is expected to launch shortly. Nearby, the Kulai area has also developed into a key hub, where YTL Corp Bhd is constructing a 500-MW campus intended to host major technology companies, including the Singapore-based SEA Ltd and US-based Nvidia Corporation.

However, while the area is projected to eventually accommodate the highest data centre capacity in the state, it faces considerable challenges—the existing industrial infrastructure was not originally designed for data centre operations, requiring significant investment to upgrade power and water systems to meet growing demand.

The concentration of data centres in these established locations has placed unprecedented pressure on local utilities, creating challenges for authorities. In response, operators are actively exploring alternative locations across Johor, including Tebrau, Ulu Tiram, Pasir Gudang, and other emerging areas, to distribute capacity, and access additional resources.

Sum observed that Malaysia’s data centre sector is currently undergoing a strategic consolidation, as it incorporates substantial new capacity, and completes key infrastructure upgrades. While this phase may lead to short-term market adjustments, the long-term outlook remains highly positive.

The sector’s expansion is supported by strong fundamentals, including accelerating digitalisation across Southeast Asia, ongoing cloud migration, and the rapid growth of artificial intelligence, which is generating unprecedented demand for high-performance computing infrastructure. These trends position Malaysia’s data centres at the forefront of technological development.

Looking forward, deeper public-private partnerships are expected to play a key role in driving sustainable growth. The combination of strong demand drivers, technological innovation, and sustainable infrastructure development suggests that Malaysia’s data centre sector is well-positioned for sustained long-term growth beyond the current adjustment period.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.