- The property is leased to Mydin under a 20-year lease agreement inked in July 2019. Bedi said the group approached Mydin with an offer to sell the property in April this year, in accordance with the lease agreement’s first right of refusal clause, with Mydin accepting the offer.

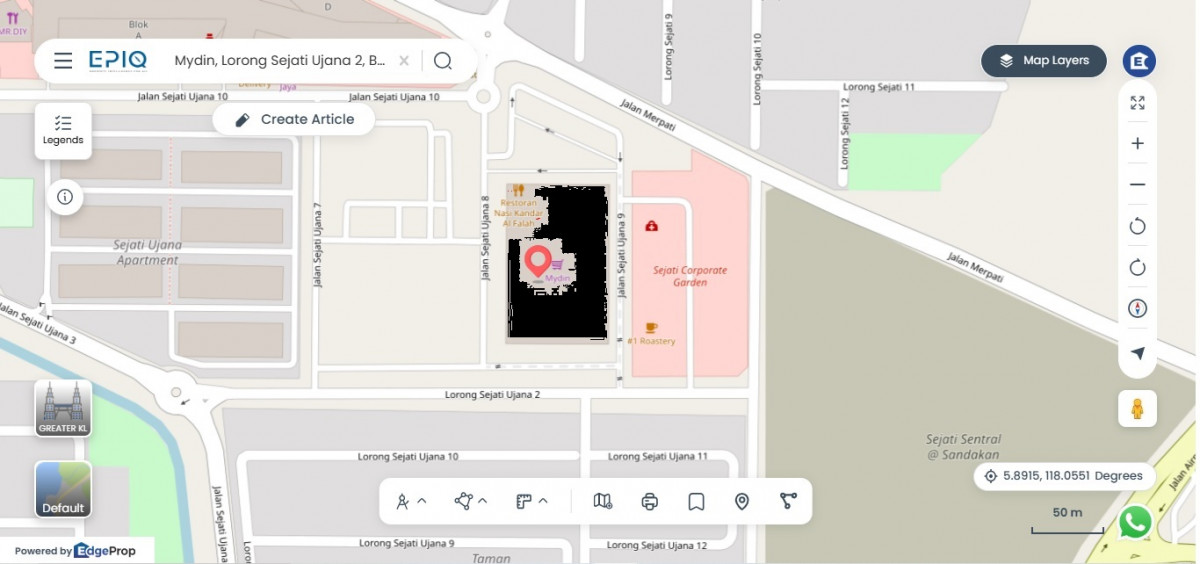

KUALA LUMPUR (Nov 13): Property developer Bedi Bhd (KL:BEDI), formerly known as WMG Holdings Bhd, entered into a deal on Thursday to sell a hypermarket property in Sandakan, Sabah to retailer and wholesaler Mydin for RM85 million. Mydin is the property’s current lessee.

The 4.39-acre land, together with a double-storey hypermarket, is valued at RM93 million as ascribed by independent valuer CH Williams Talhar & Wong (Sabah) Sdn Bhd on Nov 3, according to Bedi's bourse filing. The deal’s RM85 million price-tag represents an 8.6% discount.

The property is leased to Mydin under a 20-year lease agreement inked in July 2019. Bedi said the group approached Mydin with an offer to sell the property in April this year, in accordance with the lease agreement’s first right of refusal clause, with Mydin accepting the offer.

“The disposal is part of the group’s ongoing initiatives to rationalise its assets, with the objective to further improve the group’s overall financial position and meet its strategic business goals in the property development industry,” said Bedi.

The bulk of the proceeds, amounting to RM45.52 million, will be used to finance the property developer’s plans to acquire new properties, participate in new development projects, or acquire new strategic stakes in companies in Sabah, the group said.

Another RM35.78 million will be used to repay bank borrowings, while the remainder will be to defray the disposal’s expenses.

Bedi expects to book a net gain of RM22.1 million from the disposal, which is expected to be completed by the first quarter of 2026.

The deal is subject to Bedi shareholders’ approval at an extraordinary general meeting to be held.

Bedi saw a change in management last year after Exsim Development Sdn Bhd became its largest shareholder with a 52.5% stake.

Exsim bought the stake from Syarikat Kretam (Far East) Holdings Sdn Bhd for RM75.12 million, which triggered an obligatory takeover offer. Ben Kong Chung Vui, who acted in concert with Exsim in the offer, bought a separate 17.5% stake in Bedi from Syarikat Kretam.

Shares in Bedi were last traded on Nov 12, when it closed at 31 sen, valuing the group at RM268.82 million.

As Penang girds itself towards the last lap of its Penang2030 vision, check out how the residential segment is keeping pace in EdgeProp’s special report: PENANG Investing Towards 2030.

.jpg?KpT57Dw7Y_UzSKH8HsHP9pRQ_peOr_KV)