KUALA LUMPUR (Jan 14): Construction outfit TRC Synergy Bhd (KL:TRC) has secured a RM249 million contract to build new complex buildings in Precint 5, Putrajaya.

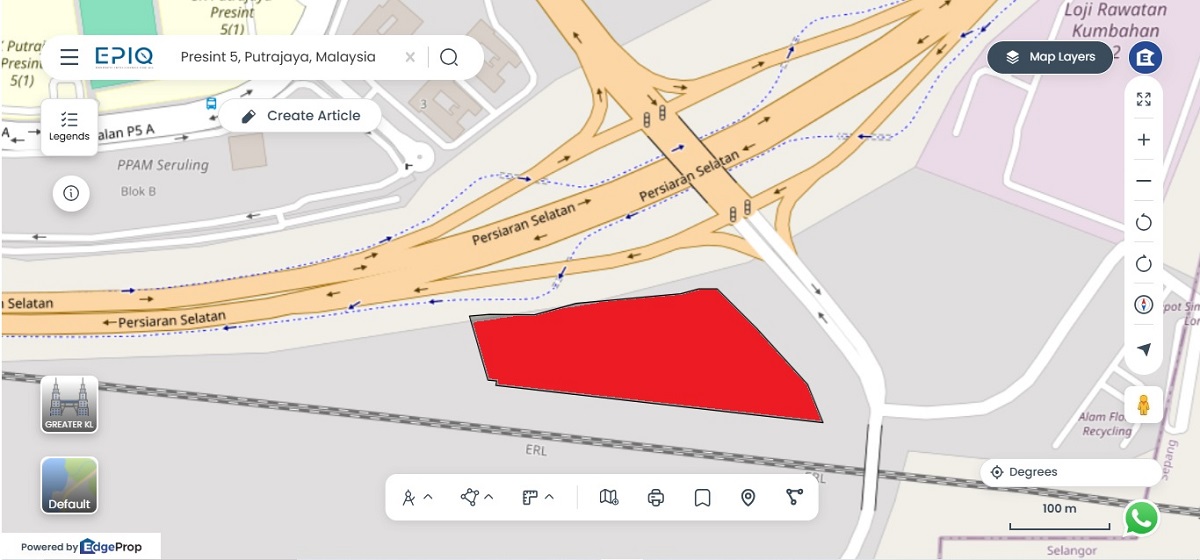

The project was secured via its wholly-owned Trans Resources Corporation Sdn Bhd from Gilang Cendana Sdn Bhd, a subsidiary of Putrajaya Holdings Sdn Bhd, the master developer of the administrative capital. The buildings are to be erected on Lot 45 in Precinct 5. No other details were disclosed.

At RM249 million, the contract value is about 42% higher than TRC Synergy’s market capitalisation of RM175.38 million as at Wednesday’s close. Shares in the group rose half a sen or 1.37% to settle at 37 sen.

Last month, TRC Synergy, via Trans Resources, secured a RM550.8 million contract from SRS Consortium Sdn Bhd—a joint venture led by Gamuda Bhd (KL:GAMUDA)— for works related to the Penang Light Rail Transit (LRT) Mutiara Line project.

TRC Synergy group is involved in construction, property development and hotel operations. Over the past nine months, its construction division has tendered for more than RM1.8 billion worth of government and quasi-government projects. As at end-September last year, its order book stood at RM468 million.

For the nine months ended Sept 30, 2025 (9MFY2025), TRC Synergy’s net profit surged 91.16% to RM16.35 million from RM8.56 million a year earlier. The increase was mainly due to the reversal of RM15.1 million in property development costs for a completed project, following an Inland Revenue Board decision on land cost computation.

Revenue for 9MFY2025, however, edged lower to RM349.26 million from RM353.5 million previously.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.