PETALING JAYA (Jan 15): Putrajaya and Cyberjaya, sitting side by side in the southern part of Greater Kuala Lumpur, are twin cities whose blueprints have been intentionally crafted to meet national aspirations: the former as the federal administration seat, and the latter as Malaysia’s Silicon Valley.

Construction in Putrajaya, spanning about 12,100 acres, began in 1995; while Cyberjaya, measuring about 7,150 acres, was launched in 1997.

Both townships, with their expansive land areas, have a prominent presence of landed homes. However, despite being established around the same time and the same geographical region, their growth paths have diverged—from each other, as well as from their own previous patterns—shaped by different planning philosophies and market drivers.

In terms of real estate developments, a check on EdgeProp EPIQ shows some interesting trajectories.

This is how they are growing differently

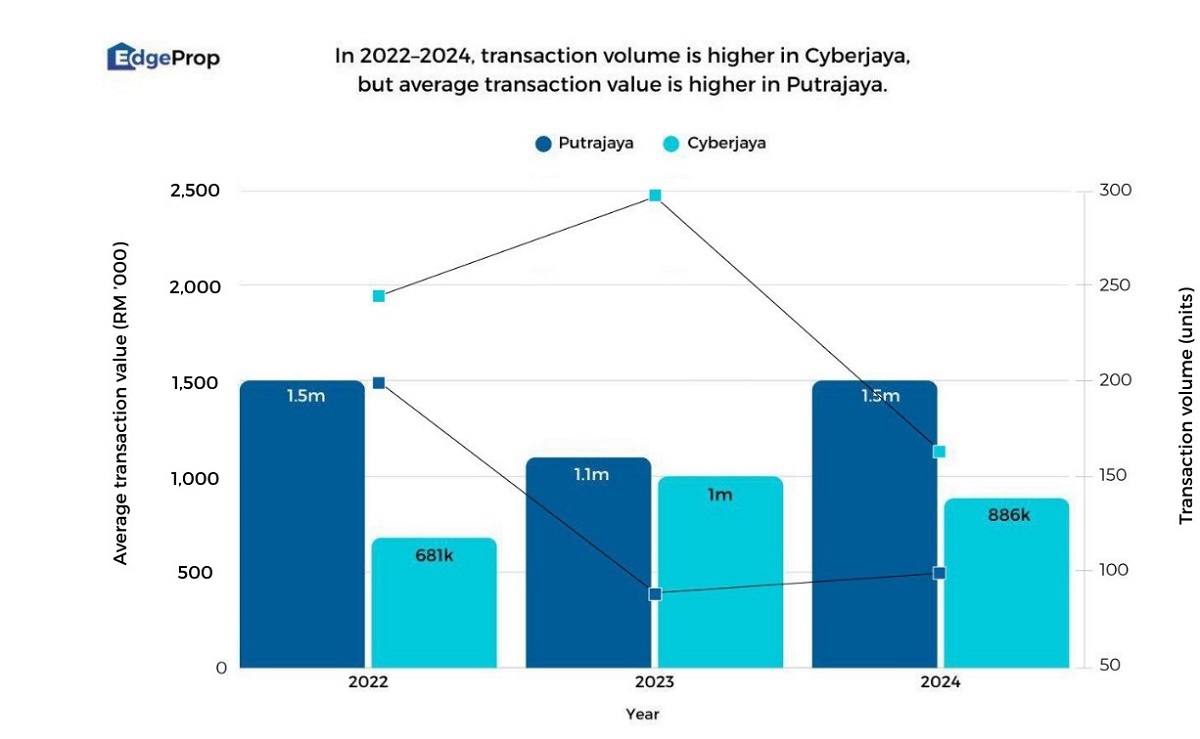

Landed transaction volumes were consistently higher in Cyberjaya. It recorded 246 landed transactions in 2022, rising to 299 units in 2023, before dropping to 164 units in 2024. In comparison, Putrajaya saw 198 landed transactions in 2022, which fell to 89 units in 2023, before a modest recovery to 100 units in 2024.

However, in terms of transaction value, landed homes in Putrajaya seem to fetch a higher premium. Despite a less active market, total transaction values in Putrajaya stood at RM308.77 million in 2022 and RM313.19 million in 2024, compared with RM424.50 million and RM308.61 million in Cyberjaya respectively. In average price, a clear contrast can be seen, as shown in the chart below.

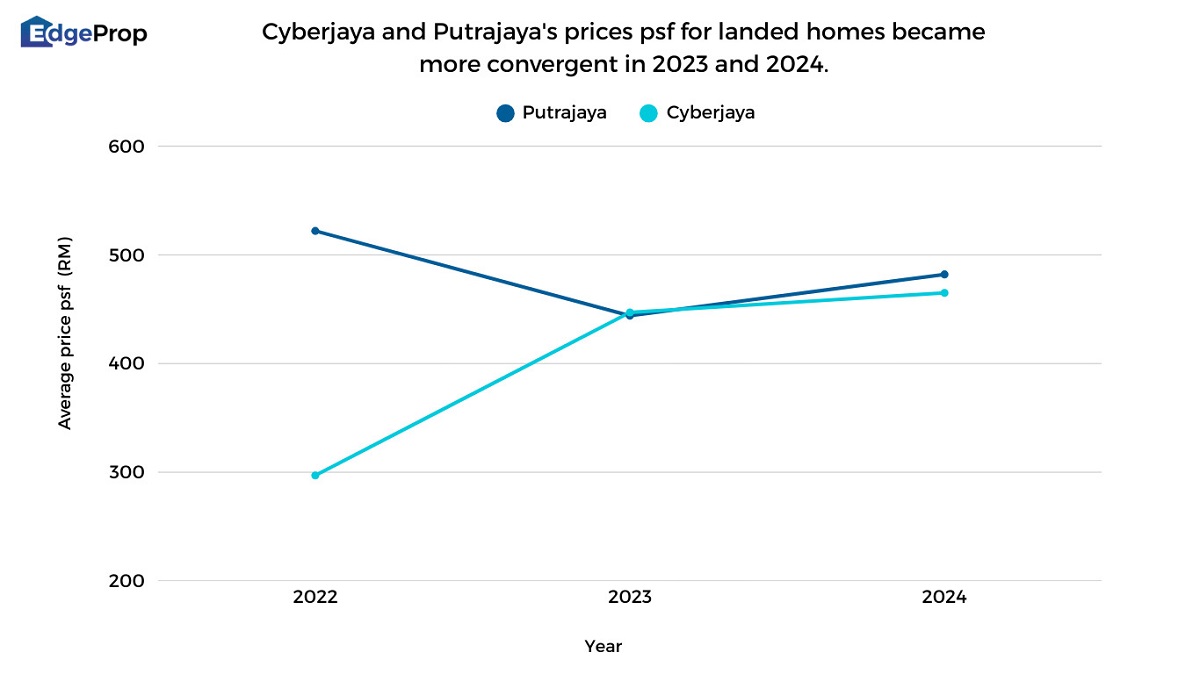

Interestingly, average transaction prices psf started with a wide gap in 2022, but began to meet almost halfway in 2023 and 2024 as shown below.

Recent transactions from EdgeProp EPIQ show a range of prices in the Putrajaya market. A semi-detached home on a 3,724-sq ft land area in Precinct 8 sold in July 2025 for RM1.18 million, while another in Precinct 18 on 2,626-sq ft land changed hands for RM1.7 million, translating to RM316.86 psf and RM647.37 respectively.

Meanwhile, Cyberjaya’s recent sales show comparative prices. A semi-detached home with land measuring 4,047 sq ft at Setia Eco Glades sold in September 2025 for RM1.58 million, translating to RM390.41 psf; while a townhouse on 1,141 sq ft land area at Casabayu @ Cybersouth changed hands for RM550,000, or RM482.03 psf.

Putrajaya starting vertical growth

Besides government centres, Putrajaya’s planned land use is defined by low-density residential layouts and extensive greenscapes. Community amenities here include Alamanda Shopping Centre, schools, healthcare facilities, Taman Saujana Hijau, and Putrajaya Wetlands Park. Connectivity to the MRT Putrajaya Line through the Putrajaya Sentral train station supports commuting, lending it a structured residential rhythm.

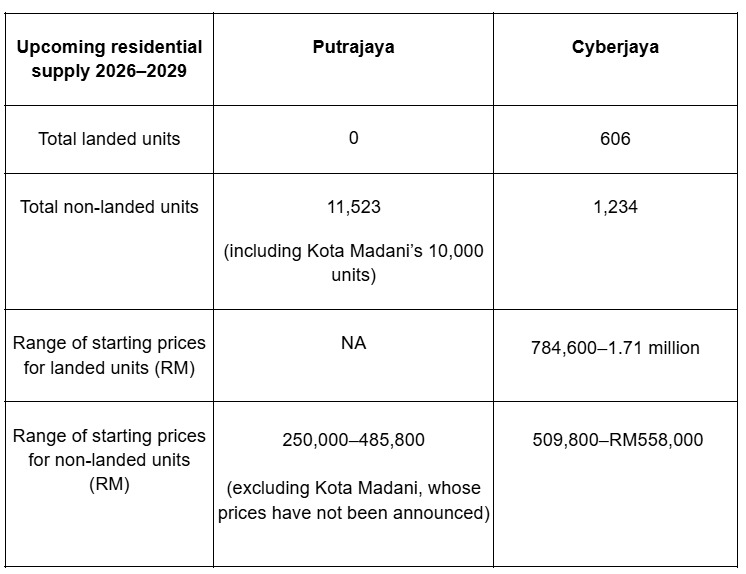

While Putrajaya’s existing housing landscape mainly features landed properties, EdgeProp EPIQ shows no upcoming landed residential projects in Putrajaya between 2026 and 2029, with new supply concentrated entirely on non-landed developments, though they remain largely low-density.

Confirmed projects include Myra Putri, an affordable low-rise condominium scheduled for completion in 2026 with 310 units priced from RM393,690; and TERRA, an integrated lakeside mixed residential development with 348 condo units, scheduled for completion in 2028 with prices starting from RM485,800.

Another apartment project named Residensi Setia Seraya is scheduled for completion in 2027. Built by Setia Putrajaya Development Sdn Bhd, units are priced from RM411,000, and out of 363 units, 311 have already been sold.

Meanwhile, Putra Idaman by OIB Properties (CV) Sdn Bhd is an apartment targeted for completion in 2028. Priced from RM250,000, it has seen 469 of its 502 units sold.

Beyond private-sector developments, Putrajaya will host the maiden government-led megaproject called Kota Madani. Spanning 102 acres, the RM4 billion township development in Precinct 19 will include 10,000 vertical units targeted at civil servants and pensioners. The first phase, involving 3,000 units, is scheduled for completion by end-2027. The remaining units and public amenities will be delivered by end-2028, while the overall development is slated for full completion by 2032.

Cyberjaya ramps up as technology-led township

In contrast, Cyberjaya is set to receive another 606 units into its landed residential supply across four projects within the same period from 2026 to 2028 (no upcoming project is recorded for 2029).

These include Allegro semi-detached (68 units), Sejati Residences terrace (170 units), Lyra Residensi terrace (182 units), and Lyra Residence 2 terrace (186 units). In addition, Avalon @ Cybersouth double-storey terrace (177 units) is targeted for completion in 2028. Prices across these projects range from RM784,600 to RM1.71 million.

At the same time, three upcoming non-landed developments are scheduled for completion between 2026 and 2028, totalling 1,234 units, with price ranges from RM509,800 to RM558,000.

The table below shows Cyberjaya’s marked divergence from Putrajaya, whose earlier phases were mostly landed and upscale, but whose new supply are all priced from below-RM500k.

In fact, both Putrajaya and Cyberjaya share common attributes of accessibility and convenience, In the latter, retail strips, neighbourhood commercial belts, and mixed-use developments cater to daily needs, while MRT stations at Cyberjaya City and Cyberjaya Utara, feeder buses, and highways reduce commuting friction.

So, what has caused Cyberjaya to pick up pace and pricing in its pipeline?

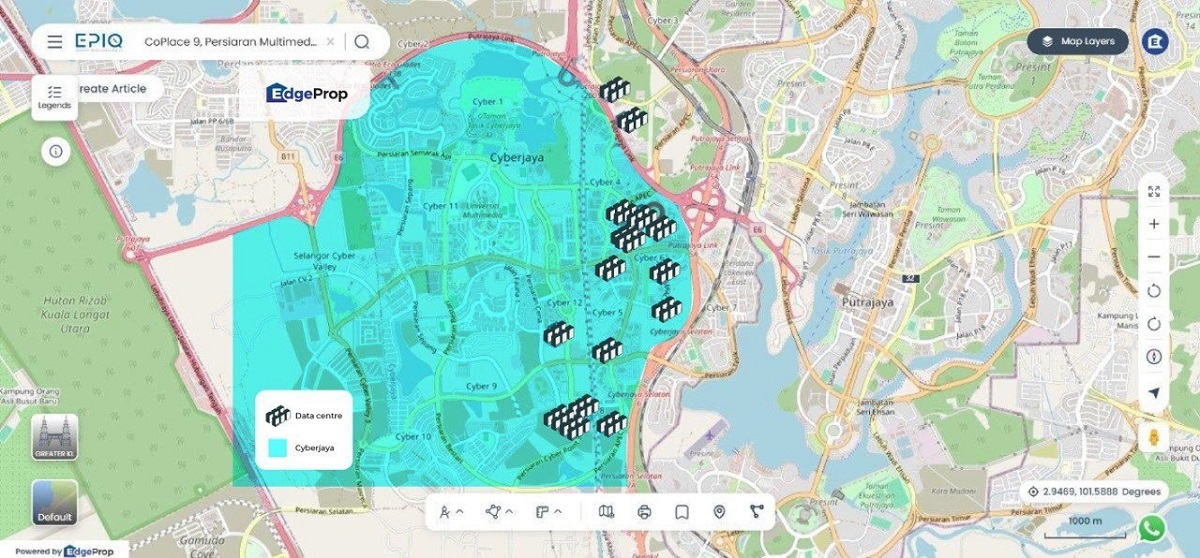

The likely reason is that, while Cyberjaya’s liveability has always been shaped by its role as a digital and innovation hub, the recent expansion of AI and cloud computing infrastructure is reinforcing the township’s character.

Major data centres, including AIMS Cyberjaya, NTT Cyberjaya 4, Amazon AWS KUL—Dengkil and Malaysia Semiconductor IC Design Park 2 (IC Park 2) at CoPlace 9, are anchoring employment clusters, in turn driving housing demand.

In short, the scale of new landed and condo supply in Cyberjaya points to continued residential activity aligned with the expanding amenities and clustering employment nodes, reinforcing its role as a technology-led township.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.