KUALA LUMPUR (Jan 21): Gamuda Land UK is advancing two core business streams in the United Kingdom (UK), with priority centred on a major office development in the City of London and a growing portfolio of student accommodation, Gamuda Land UK head Niall Emmet Farmer told EdgeProp ahead of the Rehda Institute CEO Series 2026 conference on Jan 15.

Farmer said Gamuda Land’s flagship UK asset is a 500,000 sq ft office building in the City of London, acquired in 2023 and representing the largest share of the group’s gross development value (GDV) in the market.

Since acquisition, the project has progressed through key milestones, including securing planning permission, arranging funding and signing the main construction contract. The focus has now shifted to leasing, with tenant selection and lease terms seen as critical to maximising exit value. Farmer said that information on tenants being eyed by Gamuda Land will be released in due course.

Alongside offices, Farmer said the company has continued to expand in purpose-built student accommodation. He explained that there is now a structural gap between the number of available student beds and a growing student population.

Bulk of GDV in office developments

Farmer pointed to several demand drivers, including global student mobility trends, the UK’s position as a leading education destination, changes affecting European student flows, and exchange programmes linked to leading international universities.

He added that Gamuda Land’s most recent student housing acquisition, a Stratford site first referenced last year, is being delivered without a joint-venture partner. The project is undertaken directly by the UK team, which has expanded steadily over the past three and a half years across multiple professional disciplines. This on-the-ground capability is supported by a team in Malaysia working exclusively on UK projects.

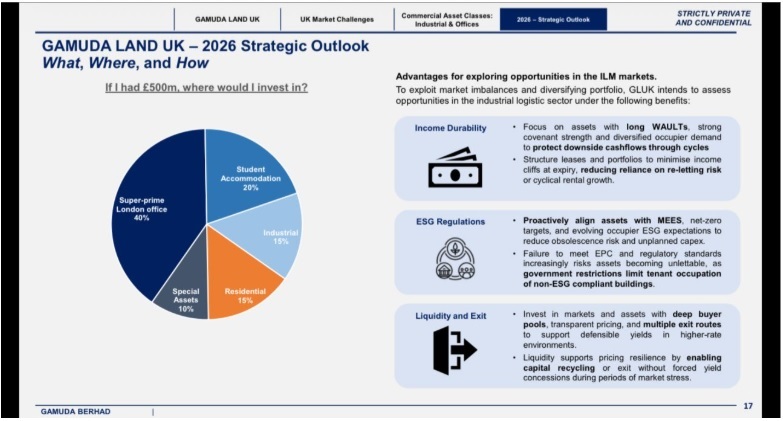

In terms of scale, Farmer said Gamuda Land UK’s current GDV stands at about £1.5 billion (RM8.17 billion), with the bulk in office developments. Student accommodation across three sites accounts for roughly £300 million, or around 20% of the total.

While offices currently represent about 70% of the pipeline, the group remains “asset agnostic” and open to further acquisitions, including additional student housing, residential projects or other commercial assets. Gamuda Land has set a target of 3,000 student beds, while retaining the flexibility to respond to market needs.

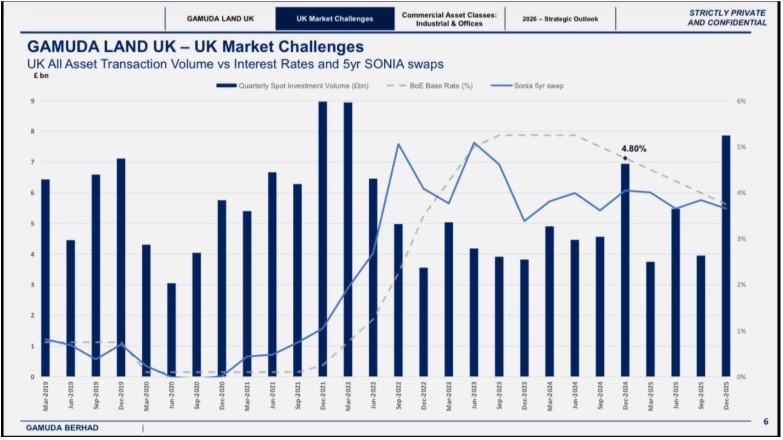

Farmer placed these projects within the context of broader UK real estate and capital market conditions. He outlined how the end of the low interest rate environment has reshaped investment dynamics, with higher base rates and rising gilt yields pushing up the cost of capital and driving repricing across asset classes.

Commercial property yields rose sharply through 2022 and 2023, but Farmer said recent data suggests pricing is stabilising, debt availability is improving and investment volumes are beginning to recover.

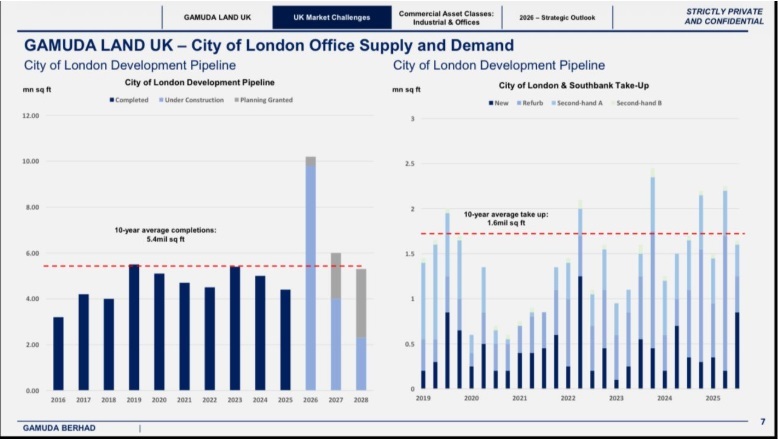

Against this backdrop, he said Gamuda Land continues to prioritise assets with strong structural fundamentals, including favourable supply-and-demand dynamics, long-term income potential and the ability to actively manage and upgrade buildings. In the London office market, Farmer highlighted historically low vacancy levels for high-quality, well-located stock, alongside rising rents, particularly in the City core. He said this has created opportunities not only in prime locations but also in “second-best” areas close to core districts, where demand is spilling over.

Strong global demand for quality student housing

Farmer also reiterated the group’s conviction in student accommodation, describing education as one of the UK’s most resilient sectors and a long-standing economic export. He noted strong global demand for quality student housing and said Gamuda Land’s developments are positioned to attract students with both spending power and expectations for well-located, amenity-rich environments.

Beyond offices and student housing, Farmer said the company is in the early stages of exploring opportunities in the industrial and logistics sector. He cited growing demand for faster delivery times, the expansion of e-commerce and a shortage of modern logistics facilities capable of accommodating advanced automation and robotics.

On regeneration-led developments, Farmer said Gamuda Land’s approach in the UK differs from its role in Malaysia. Rather than being the first mover, the group prefers to enter regeneration areas as the “second or third chapter”, leveraging existing placemaking while managing risk and capital turnaround timelines.

He added that Malaysian developers, including Gamuda Land, have a structural advantage in this space because of their experience in delivering large-scale townships that integrate infrastructure, amenities and community-building from the outset.

Farmer said Gamuda Land planned to invest in markets and assets with deep buyer pools, transparent pricing, and multiple exit options to maintain defensible yields in higher-rate environments. He explained that strong liquidity enhances pricing resilience, enabling capital recycling or exits without forced yield concessions during periods of market stress.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.