KUALA LUMPUR (Jan 26): The industrial sector has stood out as the strongest performer amidst Malaysia’s property market, which recorded mixed results across the industrial, residential, and commercial segments in the first nine months of 2025.

According to the Henry Butcher Perspective—Malaysia Property Outlook 2025 report, the industrial sector continued to outperform other property segments, recording increases in both transaction volume and value in 2025’s first three quarters.

“Despite global uncertainties, the continued good trade performance enjoyed by Malaysia, high foreign direct investments (FDIs) and domestic direct investments (DDIs) approved, favourable government policies, improvements in infrastructure, and strong interest in data centres and semiconductors will contribute to the continued good performance of the industrial sector in 2026,” Henry Butcher Malaysia chief operating officer Tang Chee Meng told reporters at the media presentation here last week.

Read also:

Inactive malls close, overall occupancy edges up—Henry Butcher

Only Johor saw upticks while other states’ residential markets stay cautious—Henry Butcher

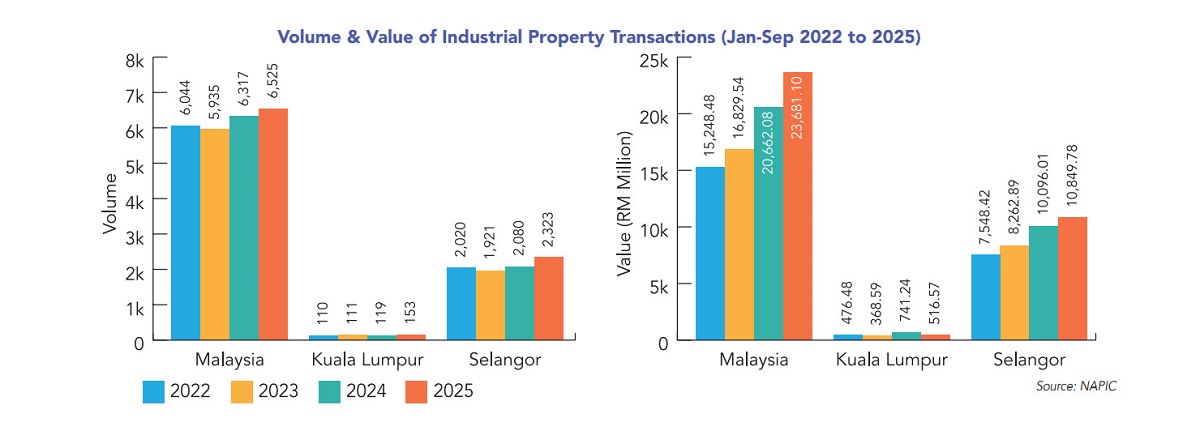

Transaction volume rose 3.3% year-on-year (y-o-y) to 6,525 units, while transaction value climbed 14.6% to RM23.7 billion. Selangor remained the dominant industrial market, accounting for 36% of volume at 2,323 units, and 46% of value at RM10.85 billion against the overall national figures.

Terrace factories contributed the highest share of transactions, followed by vacant industrial land.

Five states—Selangor, Negeri Sembilan, Kelantan, Sabah, and Sarawak recorded gains in both volume and value during the period. Negeri Sembilan posted a 19.75% rise in transaction volume to 376 units, alongside a 129.19% upswing in value to RM1.6 billion.

Kelantan recorded a 90.91% jump in volume to 21 units, and a 199.64% surge in value to RM38 million. Sabah saw volume grow 17.74% to 292 units, and value rise 3.07% to RM476.4 million; and Sarawak’s volume and value grew 12.3% and 20.85% to 557 units and RM507 million respectively.

Johor registered a slight 0.51% decline in transaction volume to 1,164 units, but a substantial 30.46% increase in transaction value to RM6.41 billion. In contrast, Kuala Lumpur saw transaction volume rise 28.57% to 153 units, but value fell 30.31% to RM516.57 million.

Penang recorded a 12.3% decline in transaction volume to 327 units, while value rose 6.4% to RM1.3 billion. However, Tang noted that Penang’s industrial sector will remain strong, supported by industrial planning and infrastructure projects such as the Mutiara LRT Line and airport expansion.

Higher-value transactions support commercial market stability

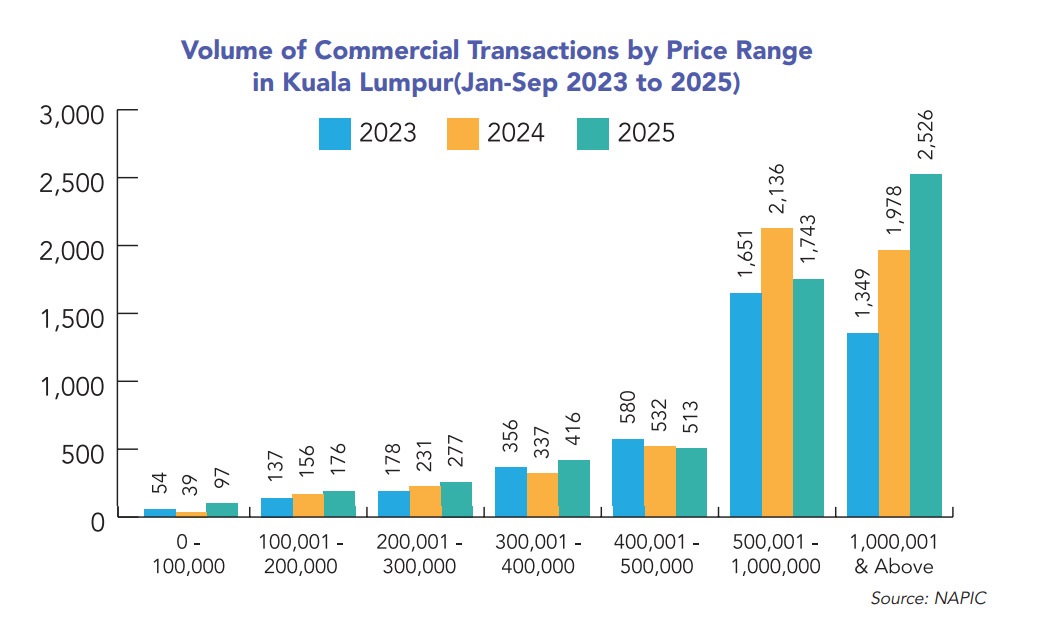

Meanwhile, overall, the commercial property sector recorded a marginal decline in transaction volume, but transaction value rose.

“The commercial sector in Malaysia recorded a marginal 2% drop in the volume of transactions to but a 16% increase in the value of transactions in the first nine months of 2025, indicating that the properties transacted were of higher values,” Tang said.

The pattern is reflected in Selangor, where the commercial transactions saw a 1.6% decline in volume to 8,374 units, but an 8% increase in value to RM10.58 billion.

Similarly, Johor experienced a 12.4% drop in transaction volume to 6,625 units, but value grew 29.5% to RM8.76 billion. Growth in Johor’s value was driven by high-value transactions in Johor Bahru, with double- and triple-storey shophouses priced RM600,000–RM2 million contributing up to 60.4% of the transactions.

However, Kuala Lumpur recorded an increase in both volume and value at 6% and close to 12% respectively. About 30% of transactions (1,743 units) were priced RM500,001–RM1 million, while 44% (2,526 units) were above RM1 million, indicating a strong concentration in the higher-value segment.

Conversely, in Penang, transaction volume declined slightly by 3% y-o-y to 1,698 units, while transaction value fell 21.6% to RM1.62 billion.

Penang island contributed 662 units valued at RM952.60 million, in the first nine months of 2025 down 2.1% and 13.5% in value compared to the same period in 2024, while Seberang Perai accounted for 1,036 units valued at RM667.20 million, declining 3.7% and 30.8% in value y-o-y.

Looking ahead, Tang said the commercial sector is expected to stay steady in 2026, although certain segments may be affected by policy changes.

“We believe the commercial sector will remain stable in 2026 with only marginal changes in the volume and value of transactions.

“However, we anticipate that the demand for serviced apartments may be affected a bit because of the hike in stamp duty for foreign buyers to 8%. KL, Penang, and Johor will be more affected than the other states,” he said.

“Visit Malaysia 2026 is also expected to support retail and hospitality sectors in established tourist and lifestyle precincts,” he added.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.