- Tan explained that this increase is fuelled by a wave of serviced apartment new launches now commanding RM1,000–RM1,500 psf, especially around the Bukit Chagar area.

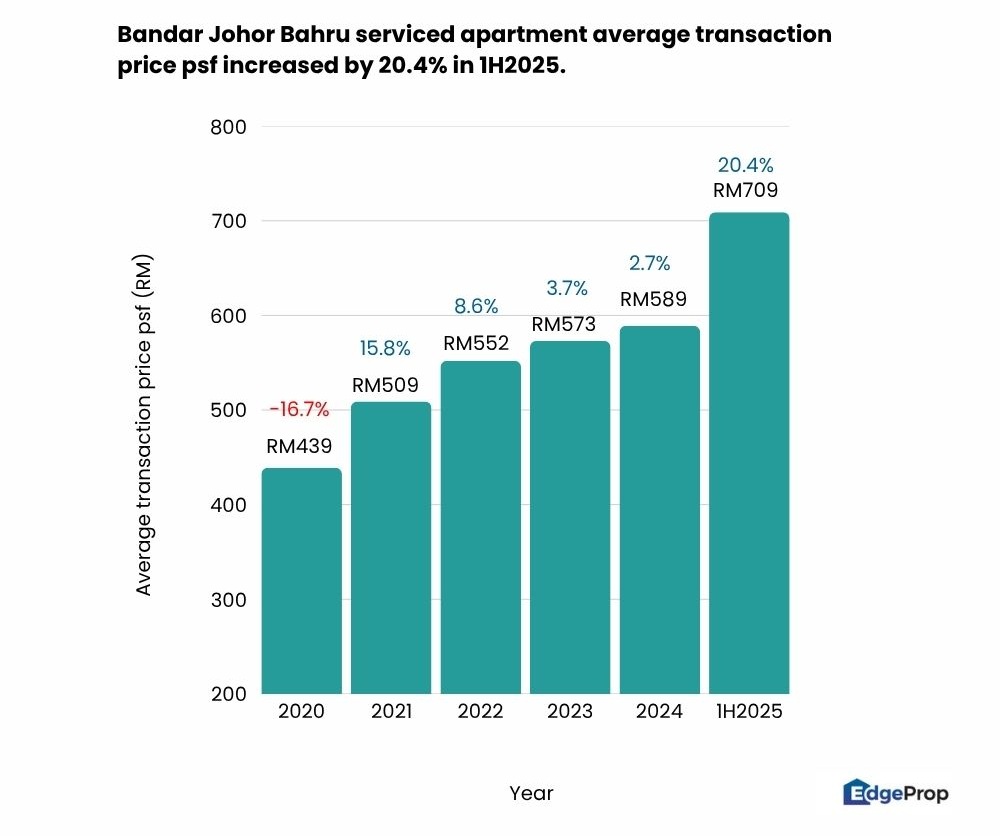

KUALA LUMPUR (July 23): Serviced apartments in Johor Bahru (JB), particularly in the JB downtown area, saw their average transaction price increase by over 20% to RM709 psf in 1H2025, according to JLL Malaysia.

“We’re witnessing an unprecedented boom in Johor’s serviced apartment market, with [average psf transaction] prices soaring by 20.4% in the first half of 2025 compared to last year,” JLL Malaysia managing director Jamie Tan said in a media roundtable presentation in conjunction with its launch of Q2 2025 Market Dynamics Report on Wednesday.

Tan pointed out that the JB hike stood out because, in comparison, data from the National Property Information Centre showed that the overall residential market in Malaysia had experienced a slight consolidation in market activity, with both transaction volume and value decreasing in 1Q2025 compared to the same period last year.

He explained that this increase is fuelled by a wave of serviced apartment new launches now commanding RM1,000–RM1,500 psf, especially around the Bukit Chagar area, where the JB-Singapore Rapid Transit System (RTS) Link’s main station will be located.

Besides that, developments like the Johor-Singapore Special Economic Zone (JS-SEZ) is also prompting developers to introduce more high-end offerings.

However, when asked, Tan acknowledged that such uptrendings should be read with caution.

“Because the market is being so hot right now, we are also a bit worried that there could be a potential over-building, oversupply situation. And that would actually cause a property bubble.

“It's very important for regulators to enforce certain restrictions, such as what can or cannot be built—specific height restrictions, and plot ratios—to ensure that there is no property glut or oversupply situation,” Tan said.

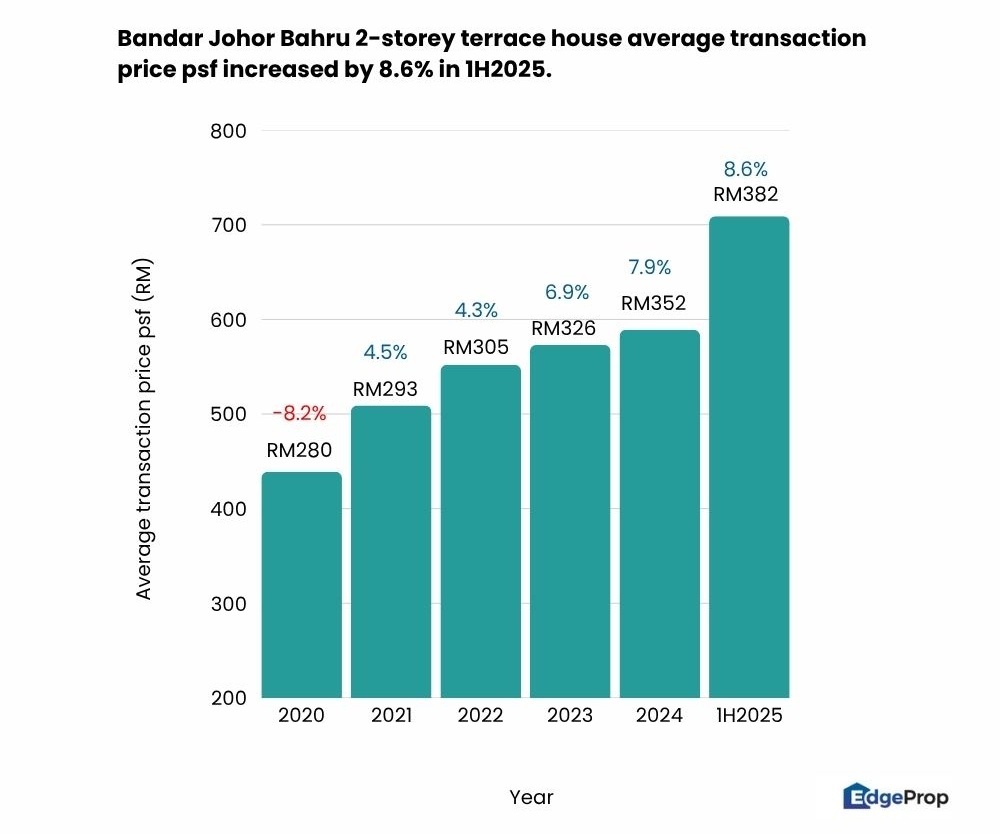

Meanwhile, the landed property market remains strong, specifically double-storey terrace houses in JB.

According to Tan, over the last two and a half years, a robust growth was seen in 2-storey terrace house average transaction prices, with a 7.9% increase to RM352 psf in 2024 and an even stronger 8.6% increase to RM382 psf in 1H2025.

He also highlighted the significant rise was also because Johor’s prices for this category started very low.

“It’s slowly ramping up, catching up with Penang as well as KL (Kuala Lumpur),” said Tan.

Klang Valley prices stay steady

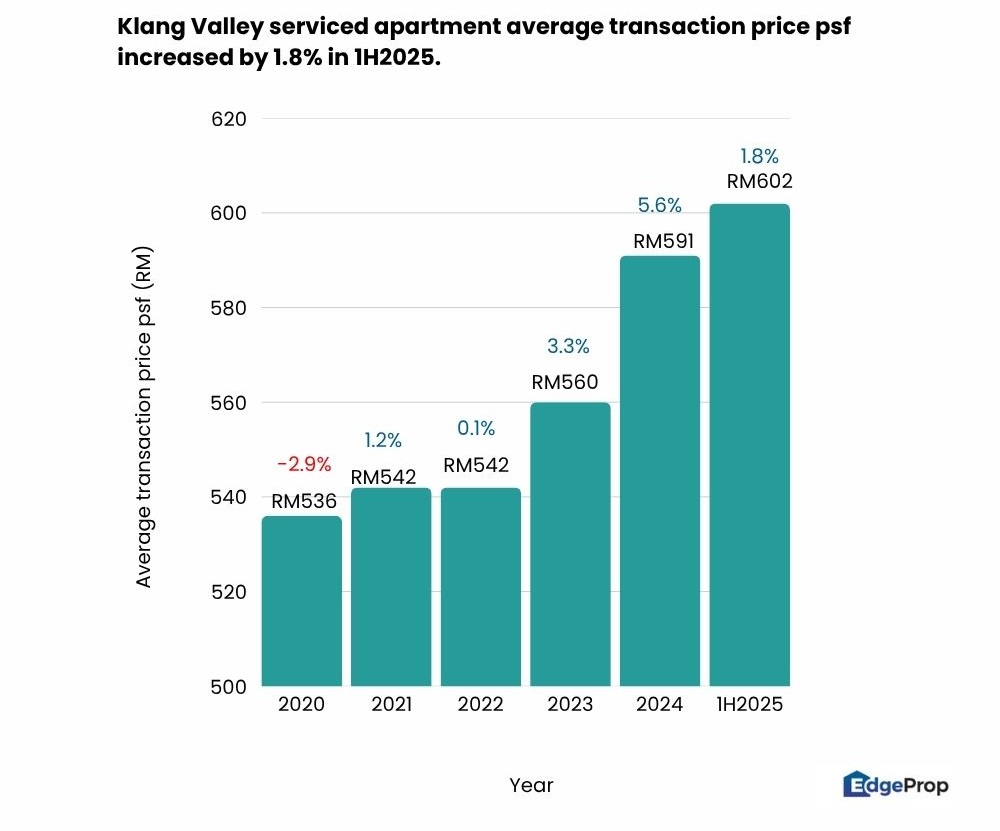

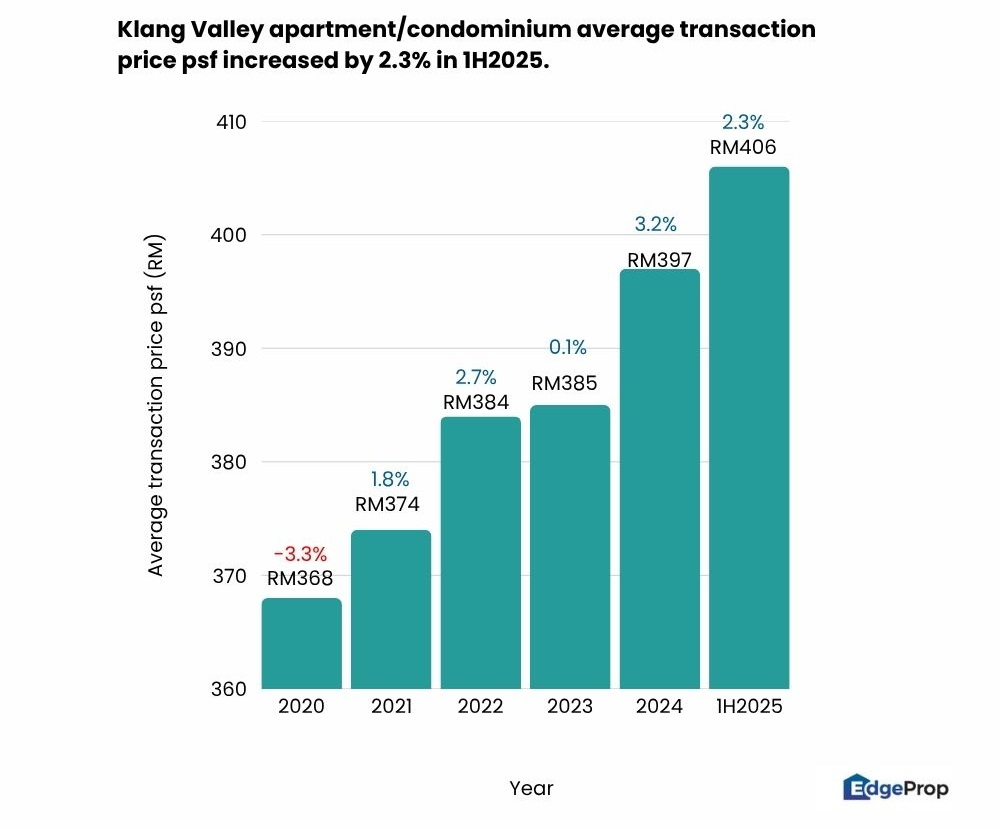

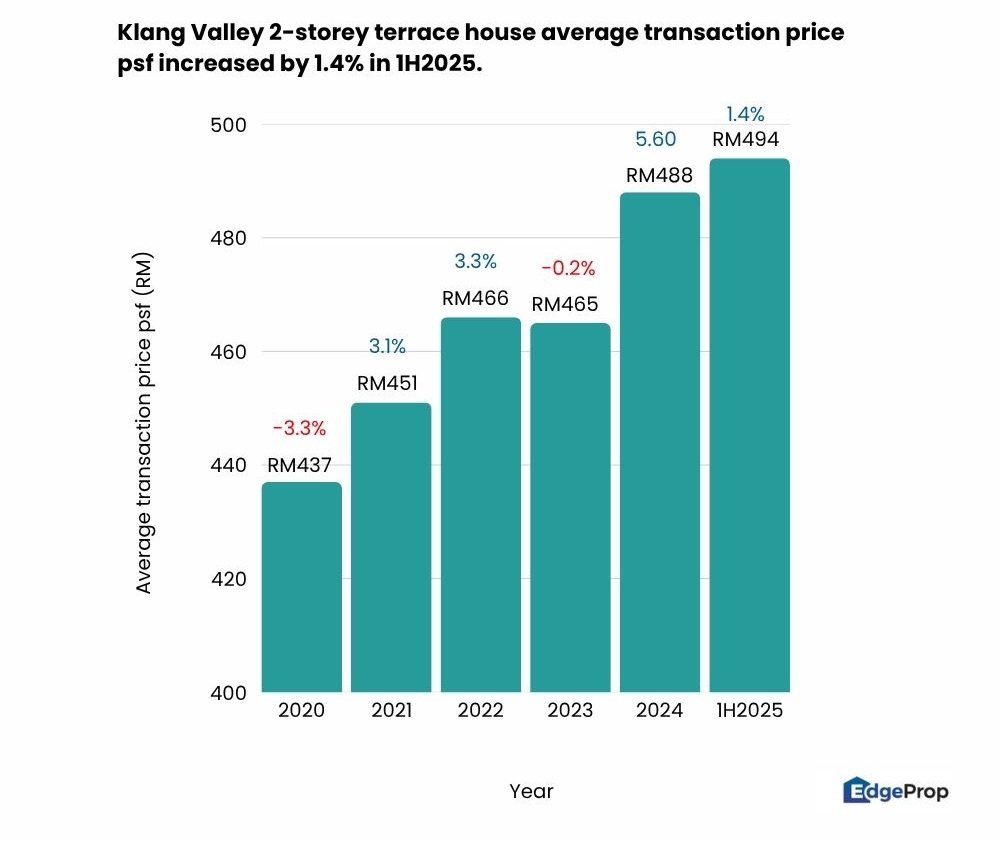

Meanwhile, in the Klang Valley, average prices of serviced apartments rose by 1.8% to RM602 psf, and condominiums rose to RM406 psf, a 2.3% increase. Two-storey terrace houses, meanwhile, recorded a price of RM494 psf, an increase of 1.4%.

“These figures indicate that prices are holding steady, with a moderate upward trend reflecting ongoing demand in key urban areas despite concerns of oversupply,” Tan said.

Luxury high-rises in KL trending up

However, the high-end residential segment for the country observed a notable uptick with both transaction volume and value increasing by 6.6% and 5.6% respectively.

“This suggests that demand from high-income earners in Malaysia remains resilient, with buyers and investors actively seeking high-end quality homes in prime locations within major cities,” he pointed out.

Tan also noted that the prime residential market added 1,443 luxury units in 1H2025 with the recent completion of Isola KLCC, The Conlay, and Bangsar Hill Park in KL city. Despite the new supply, developers generally maintained cautious positions with no significant new launches amid rising construction costs.

He said that the international demand remained strong, with investors from the Middle East, Asia Pacific, and Europe showing particular interest. Notably, Malaysia climbed to fourth place globally for Chinese luxury property investors, with Kuala Lumpur offering value at approximately US$240 (about RM1,014) psf—87% cheaper than comparable properties in Singapore.

Positive outlook for Malaysia residential market

Nationwide, residential overhang remains at healthy levels with recorded rates of 19%–23% for 1Q2025.

“Compared to the peak overhang experienced during the Covid-19 years of up to 63%, the current overhang indicates that the market has made progress in absorbing unsold units and that developers have been more cautious in their new launches,” Tan added.

Looking forward, he thinks that the residential market is looking positive, largely due to the recent overnight policy rate cut.

“Analysts anticipate another 25-basis point reduction by September 2025, aligning with the broader national trend. This OPR cut is expected to boost both the volume and value of property transactions in 3Q and 4Q2025,” he added.

Does Malaysia have what it takes to become a Blue Zone, marked by health and longevity? Download a copy of EdgeProp’s Blueprint for Wellness to check out townships that are paving the path towards that.