- “They only want fully-prepared industrial sites. Raw land has no value to them anymore.”

PETALING JAYA (Nov 27): Malaysia’s industrial growth hinges on strategic clusters, as electric vehicle (EV) makers and electronics firms drive demand for green-rated, well-connected sites in emerging regions.

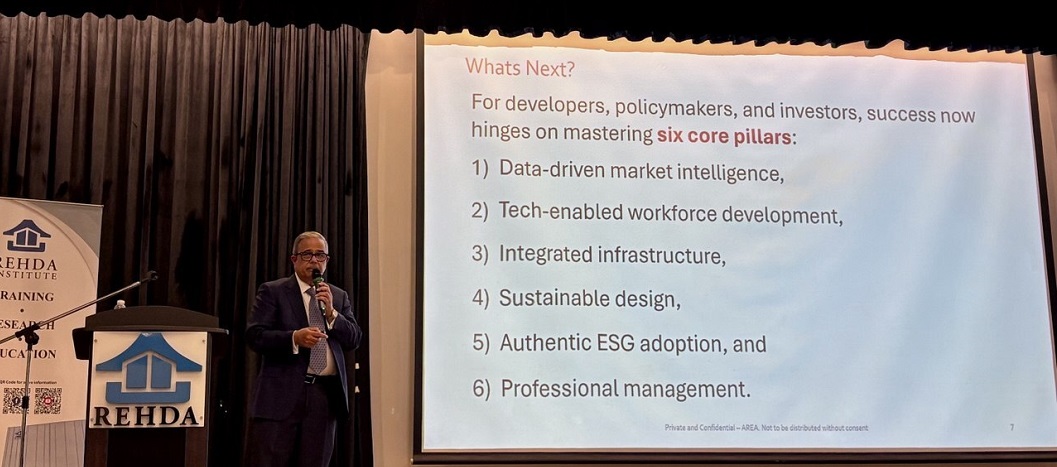

“We need intelligently-located industrial parks near population centres. You can’t put a factory in the middle of nowhere and expect people to drive there every day,” AREA Management Sdn Bhd executive chairman Datuk Stewart LaBrooy told EdgeProp at the Industrial Development Roundtable and Masterclass event organised by the Real Estate and Housing Developers’ Association (Rehda) Institute at Wisma Rehda here on Wednesday.

Read also

Semiconductor boom fuelled by local talent—Sidec

Industrial sector outlook remains stable amid evolving global dynamics, says Rehda past president

Industry experts call for faster approvals, clearer processes to boost industrial growth

While Penang and Selangor remain the country’s strongest talent hubs, he said that emerging regions like Melaka, and the “sleeping giant” Ipoh–Taiping corridor in Perak could also become significant new electronics hubs as demand grows.

He said connectivity remains a major draw for foreign investors, from airports and ports to established industrial locations.

Besides that, talent is another factor that edges up Malaysia’s competitiveness.

“Kuala Lumpur alone has a talent pool of 10 million highly educated workers, and these fundamentals continue to attract global manufacturers,” LaBrooy said.

He added that foreign manufacturers will further expand the local talent pool by training Malaysian engineers in new technologies.

“The government is focused on building a base of highly skilled, well-paid engineers. More support should also go to domestic companies. Stronger investment in infrastructure, power grids, and master-planned industrial parks is also needed,” he pointed out.

Investors eye well-equipped industrial parks

LaBrooy said Malaysia is now at a critical inflection point as global supply chains reset. Chinese manufacturers are seeking new bases outside China, but with far stricter requirements than before.

“They only want fully-prepared industrial sites. Raw land has no value to them anymore,” he said.

LaBrooy stressed that modern manufacturers increasingly require green-rated industrial parks to meet global compliance standards. Many existing parks, such as Shah Alam in Selangor, and Bayan Lepas and Batu Kawan in Penang, are not professionally managed to international benchmarks.

“New clusters are already emerging, including an automotive supply chain anchored by Proton. Incoming EV makers are expected to help position Malaysia as a right-hand-drive EV manufacturing hub for markets like the UK, India, and Australia,” he said.

He also said data centres are a major growth segment, describing them as “monsters” because of their extreme power and infrastructure demands.

“This is another reason Malaysia must accelerate the development of reliable grids and well-planned industrial ecosystems,” he added.

EdgeProp was the media partner for the two-day event from Nov 25 to 26.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.