KUALA LUMPUR (Jan 21): Sunway Bhd (KL:SUNWAY) said it is proceeding with its takeover offer for IJM Corp Bhd (KL:IJM) despite an ongoing probe by the Malaysian Anti-Corruption Commission involving the target company.

“The board of directors of Sunway wishes to clarify that the proposed offer is proceeding in accordance with the Rules on Take-overs, Mergers and Compulsory Acquisitions issued by the Securities Commission Malaysia," Sunway said in a filing.

"The proposed offer is subject to the approval of the shareholders of Sunway to be sought at an extraordinary general meeting of Sunway to be convened,” it added.

The assurance comes as analysts flagged potential delays and even calling off of the takeover offer, which was initially targeted for completion in the third quarter of this year.

Should Sunway fail to secure shareholder approval, it will be barred from making another takeover offer for the next 12 months, analysts noted.

Sunway's RM11 billion cash-and-share deal to buy over IJM was announced on Jan 12.

On Monday (Jan 19), IJM confirmed that the MACC and Inland Revenue Board visited its office to gather information amid an ongoing probe.

IJM later described allegations it was involved in money laundering as unfounded, and denied reports it is being probed by UK authorities.

Earlier on Wednesday, Bernama reported, quoting sources that the MACC has frozen RM15.8 million across 55 private bank accounts and related company accounts.

Statements have been taken from nine individuals including two of IJM's top management, with five more to be called in, Bernama reported. IJM in turn said less than 10 bank accounts have been frozen, which is not affecting day-to-day operations.

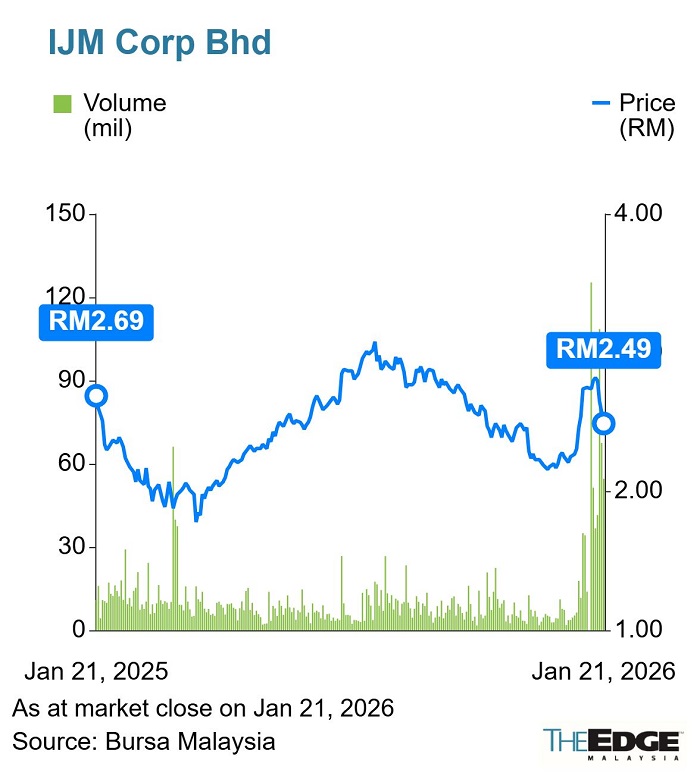

Shares of IJM have dropped since the MACC investigations surfaced, with the stock last trading at RM2.49 compared with the RM3.15 per share offered by Sunway.

Sunway's offer—itself below most analysts' target prices—trades each IJM share for 31.5 sen in cash and 0.501 new Sunway share, to be issued at RM5.65 apiece. A number of analysts have nontheless recommended for IJM shareholders to accept the offer, citing opportunity to realise their investments in IJM while holding shares in a stronger merged entity.

On Wednesday, shares of Sunway closed down two sen or 0.36% at RM5.57, giving it a market capitalisation of RM37.91 billion.

IJM closed down eight sen or 3.11% at RM2.49, valuing it at RM9.08 billion.

Unlock Malaysia’s shifting industrial map. Track where new housing is emerging as talents converge around I4.0 industrial parks across Peninsular Malaysia. Download the Industrial Special Report now.