Gamuda Bhd (March 25, RM4.93)

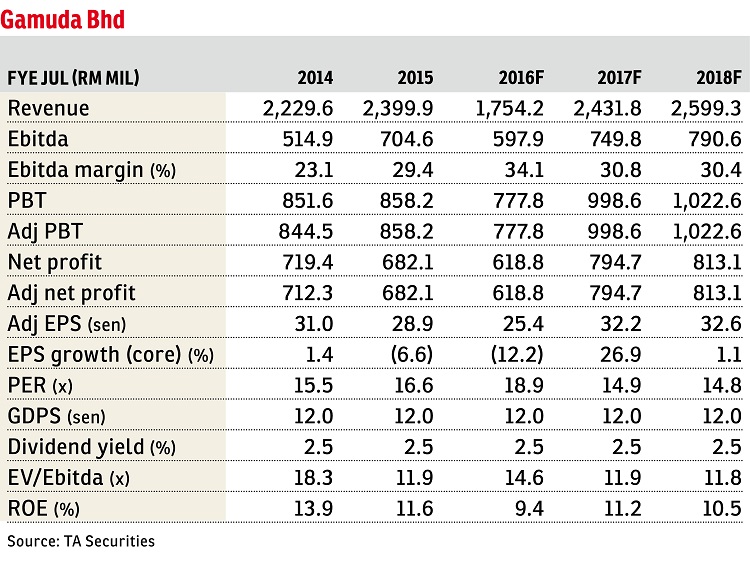

Upgrade to buy with a higher target price (TP) of RM5.57: Gamuda Bhd’s first half ended Jan 31, 2016 (1HFY16) net profit of RM321.3 million came in within expectations, accounting for 52% and 51% of our and street’s FY16 full-year estimates, respectively.

Year-on-year (y-o-y), it dropped 12.7% due to lower earnings contribution from all three core divisions, namely construction, property and concession. The 33.5% fall in construction profit before tax was expected as the construction works for mass rapid transit (MRT) Line 1 tapered off. Its property division recorded a lower revenue (down 13.4% y-o-y) and margin (3.3% lower) amid softening of the property market. Gamuda’s concession earnings were marginally lower (down 1.7%) as drops in tollable traffic on its highways after the toll hikes in mid-October 2015 were offset by higher contractual toll rates effective the beginning of 2016.

Quarter-on-quarter, Gamuda’s net profit was almost unchanged at RM160.1 million as lower profits before tax in the construction division (7.4% lower) and property division (8.1% lesser) were offset by a better performance of its concession division (up 7.1%).

On its construction division, Gamuda’s management guided that the awards for the MRT Line 2 underground package and two elevated packages are imminent. We strongly believe that the MMC Corp Bhd-Gamuda joint venture (JV) would secure the underground package given its: i) familiarity with the ground condition after undertaking the underground works for MRT Line 1; ii) strong execution track record with MRT line 1; iii) cost advantage as the tunnel boring machine used in MRT Line 1 could be reused for MRT Line 2; and iv) advantage under the Swiss Challenge tender method, which allows the JV to match or better the best bid submitted by competitors.

The total cost of MRT Line 2 is estimated at between RM28 billion and RM30 billion. We estimate the contract sum for MRT Line 2 underground works to be RM12 billion to RM13 billion. This is higher than the RM8.2 billion value of MRT Line 1 given the lengthier tunnelling works (13.5km versus 9.5km) and an increased number of stations (11 versus seven).

As for its property development division, the group achieved property sales of only RM115 million in the second quarter ended Jan 31,2016 (RM385 million in 1HFY16), versus management’s guidance of RM1.32 billion and our assumption of RM1.2 billion for FY16. We see downside risks to the FY16 sales target. Gamuda’s unbilled sales declined from RM1.2 billion a quarter ago to RM1 billion. Its property projects in Vietnam achieved mixed results with Celadon City in Ho Chi Minh City meeting expectations while the sales at Gamuda City in Hanoi began to slow down.

On its concession division, with toll hikes ranging from 31% to 100% for several highways under Gamuda’s portfolio, namely Damansara–Puchong Expressway, Sprint Expressway, and Stormwater Management and Road Tunnel, the traffic volume experienced 3% to 8% decline during the initial stage of the toll hikes but the traffic volume has recovered half of its initial decline. There is no significant progress on the negotiations between the federal and state governments on the disposal of its water asset Syarikat Pengeluar Air Sungai Selangor Sdn Bhd.

We maintain our earnings projection on the group. As the construction works for KVMRT Line 1 are tapering off and property sales for FY15 have slowed down, we expect to see a drop in earnings in FY16 before rebounding in FY17 as works for KVMRT Line 2 pick up momentum. FY17 is expected to be the beginning of a new cycle of earnings growth.

We rolled forward our valuation base year to calender year 2017 (CY17) and arrived at a higher TP of RM5.57 from RM4.74 previously, based on 20 times CY17 construction earnings, 14 times CY17 property earnings and 16 times CY17 earnings from toll road and water concessions. We upgrade Gamuda to “buy” given the visibility of earnings growths in FY17 and FY18. — TA Securities, March 25

This article first appeared in The Edge Financial Daily, on March 28, 2016. Subscribe to The Edge Financial Daily here.